Does MM like Syrah Resources Ltd (SYR) for graphite exposure?

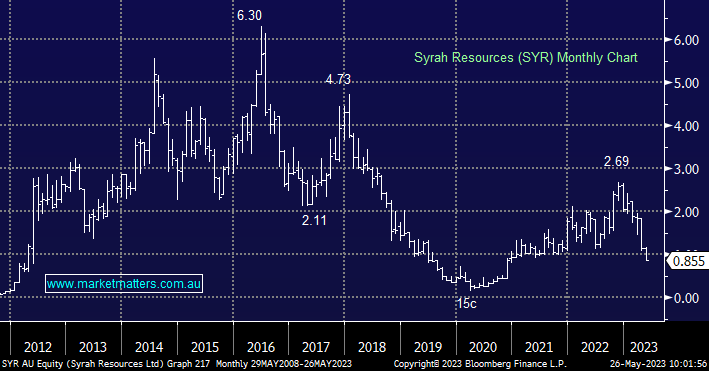

Thanks a lot for taking this question. Syrah Resources is the only vertically integrated, natural graphite, active anode material producer of scale outside of China. Telsa is a foundation customer; and it is building a large active anode material facility in Louisiana. It has US$84m in cash to fund these activities, and will access the US Department of Energy Loan and Grant, supplied under the US Clean Energy Inflation Reduction Act. The Share price closed at $0.855 25/5 (52 Week High $2.69 and Low $0.845). The Non-Executive Chairman has bought 200,000 shares total $182,000 at $0.91 per share on 19/5. Would like to know what is your opinion on SYR short to medium term. Thanks again for taking this question