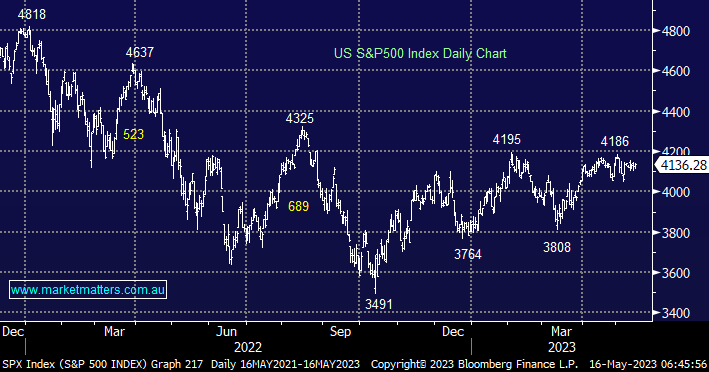

US stocks edged higher overnight led by the Tech Sector, software business NVIDIA Corp (NVDA US) closed up +2.2% contributing the most number of points to the S&P500 in the process. The AFR described the market as being in a state of flux and this has felt on point of late, our preferred scenario is still the S&P500 makes fresh highs back above 4200 but failure into such strength wouldn’t surprise MM and we remain very open-minded as to what comes next.

- No change, we believe the risk/reward currently favours selling strength as opposed to chasing any breakouts on the upside.

The US Regional Banking stocks have started to absorb potentially bad news and after plunging over 65% we believe the sector is looking for, or may have found a short-term low. The read-through from this opinion is that the negative external influences that have washed through global banks are likely to be diminishing fast.

- We now believe the next 15-20% move for the regional banks is more likely on the upside – nothing major in the context of the last 16 months.