What Matters Today in Markets: Listen Here each morning

The ASX200 spent another day feeling tired on Thursday only to recover from early selling to end the day down just -0.05%, winners and losers were pretty evenly balanced with performance under the hood almost a total reversion of many moves on Wednesday:

Wednesday: Mineral Resources (MIN) +2.7%, Pilbara Minerals (PLS) +3.9%, IGO Ltd (IGO) +4%, BHP Group (BHP) +1.5%, and Sandfire Resources (SFR) +0.6%.

Thursday: Mineral Resources (MIN) -5.5%, Pilbara Minerals (PLS) -4.9%, IGO Ltd (IGO) -3.9%, BHP Group (BHP) -2.6%, and Sandfire Resources (SFR) -1.7%.

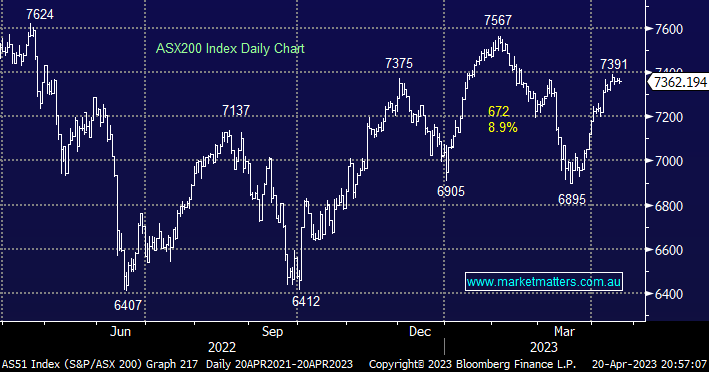

This is a market where investors must stand back and form an opinion and position themselves accordingly if we get too close it will feel akin to watching a tumble drier going around & around with portfolio performance likely to suffer as a result of the feeling of nausea! There are numerous opportunities presenting themselves for investors this year even if many feel its too hard and markets are making no sense e.g. with the end of April in sight the ASX200 has produced 32 stocks which are up +20% or more while 7 have declined by the same degree, in other words almost one-fifth of the market has moved by more than 20% while the ASX200 itself has rallied just +4.6%.

Our 2 main “mantras” at the start of 2023 are playing out nicely and we see no reason to deviate from this even if it does feel uncomfortable at times:

- Buy weakness and sell strength with more emphasis on the buying side of the equation – the risk/reward around 7400 is leaning towards the sell side of the ledger.

- The most alpha will be added to portfolios in 2023 through acute stock and sector rotation as the economic cycles play out – ytd performance has been led by Tech & Consumer Discretionary names while the Energy Sector is the only group down.

Yesterday we followed our recent notes and edged our Flagship Growth Portfolio down the risk curve by selling Sandfire (SFR), and trimming CSL Ltd (CSL) & REA Group (REA) while we added Treasury Wines (TWE), our cash position increased from 8% to 11%.

- Following a -0.6% fall by the S&P500 on Wall Street the SPI Futures are looking for the ASX to open down around 30 points with BHP likely to be a major drag after falling $1 in the US.