What Matters Today in Markets: Listen Here each morning

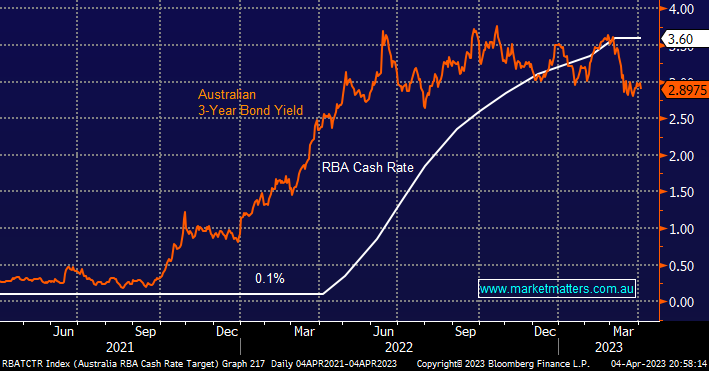

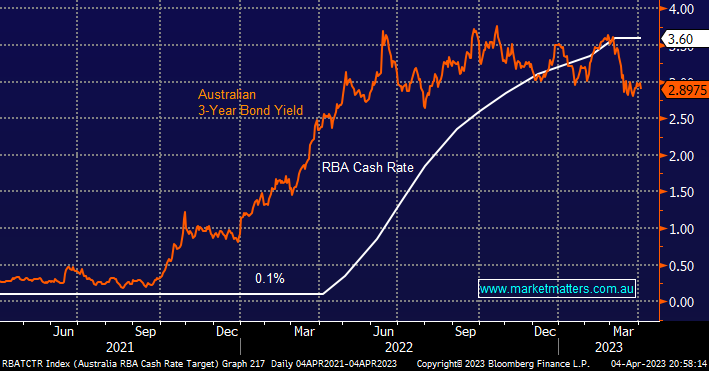

The RBA left interest rates unchanged at 3.6% yesterday, it was their first pause after 10 consecutive hikes which has seen the Official Cash Rate soar from 0.1% to 3.6%. Much has been written about Tuesday’s meeting both before and after hence this morning we’ve focused on what MM believes are the salient points of the accompanying RBA minutes and our subsequent interpretation:

- “The Board recognises that monetary policy operates with a lag and that the full effect of this substantial increase in interest rates is yet to be felt.” & “The outlook for the global economy remains subdued, with below-average growth expected this year and next.”

- “A range of information, including the monthly CPI indicator, suggests that inflation has peaked in Australia.” & “The central forecast is for inflation to decline this year and next, to around 3 percent in mid-2025.”

- “The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target” – i.e. the 2-3% range.

Our view is that with the “Mortgage Cliff” about to start weighing heavily on the Australian economy, especially over the next 6 months, the only prudent course of action is for the RBA to wait and see exactly how much pain will be inflicted on the 880,000 households who are going to see their fixed rate periods expire this year. We have 2 fairly bold statements to reiterate from our last few reports:

- We believe the RBA Cash Rate will remain at 3.6% at least until Christmas.

- however we do not believe there will be any rate cuts until after we’ve heralded in 2024.

Obviously, there are macro-economic events that can derail both of these opinions such as another Banking Crisis, a commercial property collapse, or the mortgage cliff weighing heavily on the local housing market but we cannot second guess unknowns just evaluate the risk-reward at the time:

- If stocks start to price in rate cuts later in 2023 we believe it will be time to migrate back down the risk curve with a bias away from interest-rate-sensitive names.

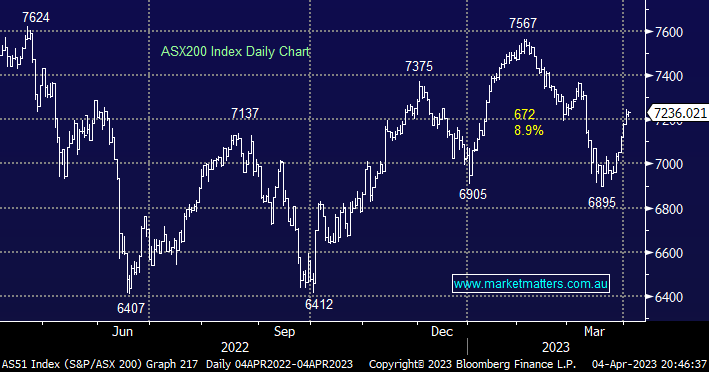

The ASX200 embraced the RBA’s rate decision on Tuesday taking the local index to its 8th consecutive gain, with the interest rate announcement in the rear-view mirror and Easter looming fast we wouldn’t be surprised to see the local index consolidate for a few days in the 7200-7250 area. As the overall markets upside momentum slowly wanes the action under the hood has remained very interesting over the last month as investors focus on peak interest rates:

Winners: Telcos +4.6%. Consumer Discretionary +4.3%, and Tech +4.1%.

Losers: Energy Index -4.6%, Materials -3.2%, and Real Estate -1.6%.

The performance elastic band is stretching toward the rate-sensitive names at the expense of stocks most exposed to a global recession, it’s been our view since late 2022 that this would unfold before going too far as markets price in rate cuts later this year. The time to consider reweighting back towards value stocks from growth is approaching especially as we take into account our current overweight skew towards tech stocks in our Flagship Growth Portfolio.