What Matters Today in Markets: Listen Here each morning

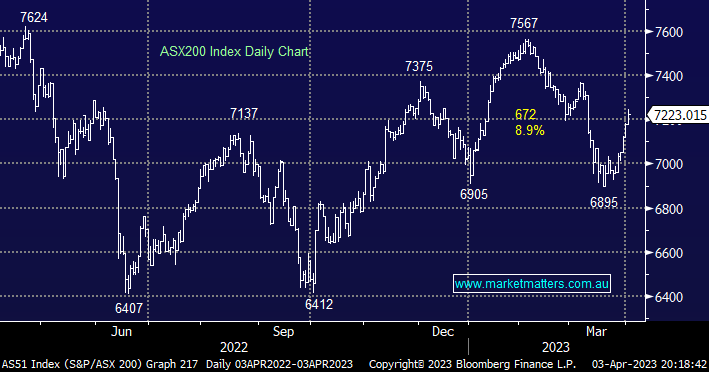

The ASX200 enjoyed its 7th consecutive day of gains on Monday as the local market focused on an interest rate pivot by central banks as the banking crisis fades further into the distance. Gains were broad-based with 70% of the main board contributing to the 45-point advance but it was the strong performance by the banks, energy, and tech stocks which overcame some noticeable losses in the miners, and in particular the iron ore names. However, the index closed well below its highs as investors digested the strong move by oil courtesy of OPEC+, a fascinating dynamic that could be interpreted either way depending on the mood of the market on the day.

- Remember MM’s mantra for 2023: “Buy weakness and sell strength with an emphasis on the bullish side of the equation” – so far so good as we enter Q2.

The decision by the Oil Cartel over the weekend to cut production by more than 1 million barrels per day sent Brent Crude roaring up by ~8% on the open yesterday before relative calm returned and the July contract spent most of our day session up just over 5%. However, the announcement created plenty of uncertainty as investors looked very comfortable selling strength taking the index down -0.3% from its early morning high following strong gains on Wall Street:

- Most tech stocks drifted from their highs through the day as fears grew that higher oil prices would kick inflation higher derailing optimism that rate rises are at an end.

- Similarly most oil stocks saw their highs early in the day as investors took the opportunity to sell into the bounce courtesy of the OPEC+ decision.

In theory, these 2 groups should have moved in opposite directions but after the market’s impressive 5% recovery from its March low, it’s not surprising to see some investors take some money off the table. Following 7 straight days of gains some consolidation would be common but the RBA decision today could easily introduce some further volatility into the mix.

- MM is looking for the RBA to pause today, out of the 4 major banks we’re siding with CBA looking for no more hikes.

US stocks experienced a mixed session overnight with the Energy Sector posting its best result since October while tech names surrendered some of their recent gains on inflation fears. Treasury yields slipped lower as manufacturing data was weaker than expected, which could imply a weaker read on jobs come Friday’s important Non-Farm Payrolls release. A ~6% fall by Tesla (TSLA US) weighed on the NASDAQ which fell -0.25%.

- Following the +0.4% advance by the S&P500 the SPI Futures are pointing to a small gain this morning not helped by a 70c fall by BHP in the US.