What Matters Today in Markets: Listen Here each morning

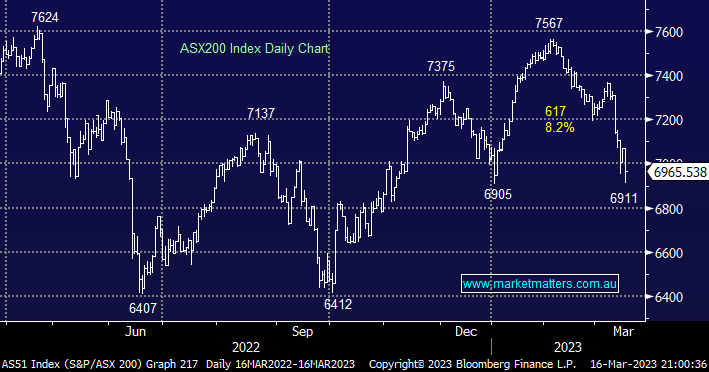

The ASX200 tumbled another -1.5% on the penultimate day of a volatile week which has already seen the local index lose over 200 points as banking stocks came under intense selling following the 2 major failures in the US, SVB & Signature, and what looks like two near misses with First Republic Bank (FRC US) and Credit Suisse in Switzerland. After rallying strongly through January the “Big Four” Australian banks are now down an average of -5.4% year to date, well over -10% below their February highs.

- Global regulators are working overtime to ensure we don’t witness a GFC-style systemic failure across banking stocks but there’s a big difference between supporting companies and giving stocks a reason to rally.

- Overnight we heard that US First Republic Bank (FRC US) is to get $US30bn in deposits from fellow banks such as JP Morgan Chase & Co.

It’s not often that the Australian jobs data takes a back seat on the news front but that’s undoubtedly what happened yesterday with the local unemployment rate coming in at 3.5%, below the expected 3.6%, and well under Januarys 3.7%, but the movements across bond markets are not what’s driving equities this week although we believe it will be before the end of March which MM believes should ultimately be supportive of stocks and in particular rate sensitive growth names.

- We have been flagging weak employment data on the horizon and it’s our opinion that yesterday’s number is the beginning of more to come.

- Hence MM believes the futures markets were correct yesterday that the RBA has finished hiking at least for now – we are attributing a 20% possibility of one final move up to 3.85%. UBS has a similar view, while they are going a step further and forecasting a cash rate of 2.5% by the end of next year.

- However overnight we saw the European Central Bank (ECB) hike their benchmark rate which increased bets the Fed would follow suit next week which might influence Philip Lowe.

US stocks experienced a volatile but ultimately positive session overnight following the support of First Republic Bank which saw the S&P00 advance +1.8% and the NASDAQ again outperform +2.7% even as Treasuries fell and rates rose after the ECB hiked interest rates. The Tech stocks are focused on the future path for interest rates as opposed to the current turmoil in the Banking Sector – on the sector level Tech rallied +2.8% while the Financials bounced +2%.

The SPI Futures are pointing to a modest 27-point gain this morning not helped by a small drop by BHP in the US plus of course in todays uncertain times who wants to go home long into the weekend?

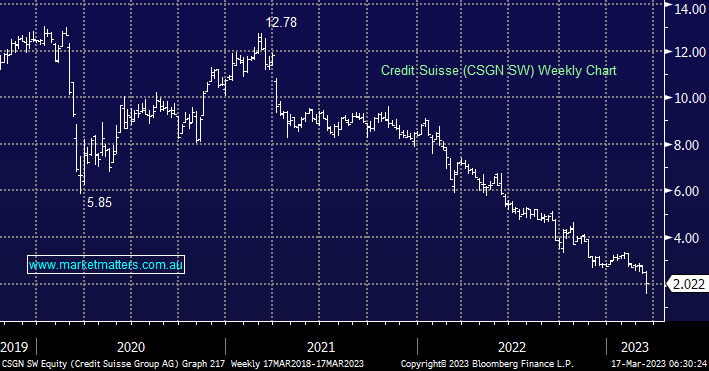

Credit Suisse has already tapped the Swiss National Bank for up to US$54b, with the hope of containing the issues, to put things into perspective that’s more than Westpac’s (WBC) entire market capitalisation. Overnight we saw the Swiss bank bounce +19% following its huge lifeline although it lost over 50% of its initial gains following the news, similarly, FRC bounced +6% following its initial support package but it’s still down ~70% over the last 48 hours.

- While we believe Credit Suisse will survive it’s hard to value as it walks around cap in hand. The trend has been our friend on this one!

Two stocks MM holds caught our attention in the winner’s enclosure yesterday as the market rapidly evolves from one fixated on rising bond yields to one that’s concerned about failing banks and a looming recession.

- The performance banner is being passed away from the beneficiaries of rising interest rates such as Computershare (CPU) to the battered names who have been weighed down by the unrelenting hiking of interest rates by central banks.