What Matters Today in Markets: Listen Here each morning

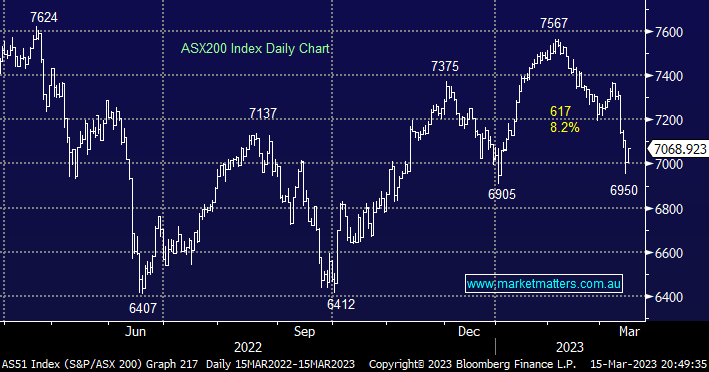

The ASX200 bounced a healthy +0.9% on Wednesday with over 75% of stocks closing up on the day although the market still feels fragile since the recent demise of Silicon Valley Bank (SIVB US) and Signature Bank (SBNY US) – the 2nd and 3rd largest banking collapses in US corporate history. Not surprisingly the US regulators have stepped in to avoid contagion and while we believe this version of the “Fed Put” will successfully avoid another banking crisis it might not be enough to lift equities significantly higher – risk assets still have a relatively high-interest rate environment to overcome & volatility in bond markets has become extreme.

- The Fed and Treasury have guaranteed all deposits with the two failed banks plus they’ve set up a lending facility to lend against government bonds which are worth well under 100c in the dollar since the Fed started hiking interest rates.

- Now that US officials have drawn a major line in the sand it’s hard to imagine they wouldn’t step in again if required by other financial institutions – we ponder if they will help individuals when they can’t pay their mortgages after rates have soared.

With no forced selling looking likely in the bonds the uncertainty returns back to the Fed, will they hike this month, and if so by how much – markets have switched from 0.5% to zero and now back to 0.25% all in just a few days. In the current market, a week is a very long time but if Credit Suisse survives the coming few days we can see calm slowly returning to financial markets and the Fed being comfortable to hike potentially one last time.

- MM’s hunch is the Fed will still hike 0.25% next week but it’s a close call in today’s rapidly evolving & uncertain environment, whatever the decision the accompanying rhetoric will exert the greatest influence on stocks.

- Locally on the index level we see initial strong support in the 6900-7000 area but we will not turn outright bullish unless we see a close back above 7200, another 2% higher.

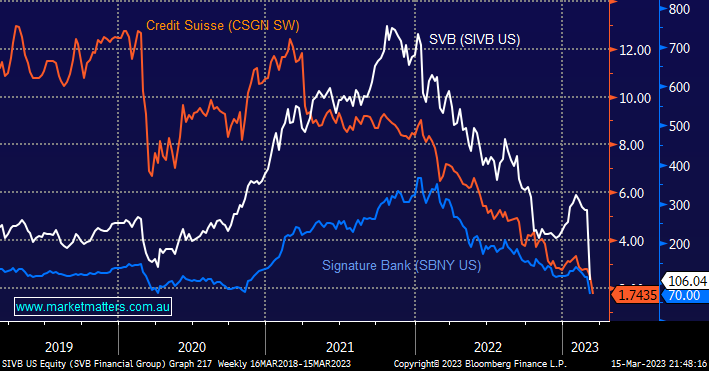

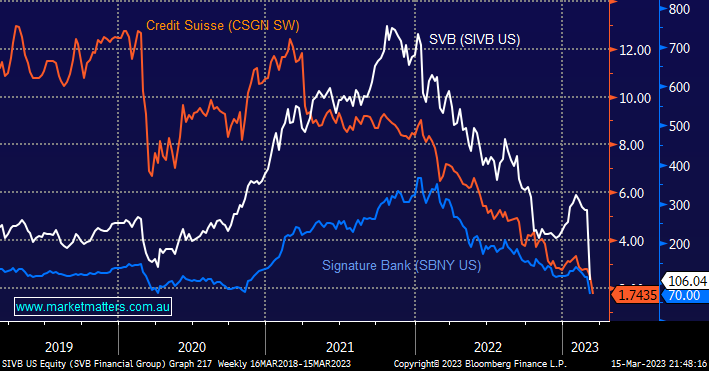

US stocks experienced another tough session overnight as Credit Suisse (CSGN SW) plunged ever lower, the European investment bank closed down a scary -24% with the Swiss Government now looking at options to stabilise the bank – ironically economists were focusing on consumers and mortgage holders being pressured by rate hikes over the last 12 months but it has been the banks that appear to have suffered the most since central banks relentlessly marched down their hawkish path.

- Following weakness by the Banking Sector in Europe the S&P500 fell -0.7% overnight while the NASDAQ again managed to eke out gains advancing +0.4% – the banks, insurers, and energy names bore the brunt of the selling in the US.

- The SPI Futures are pointing to a -1.6% fall by the local market with banks and resources both looking vulnerable e.g. oil fell -3.8% overnight and BHP closed down -$1.60 or 3.6% in the US.

“The trend is your friend” is regularly trotted out by stock market pundits but statistically there’s plenty of truth in these famous 5 words i.e. some of the world’s best-performing funds only buy stocks making new highs while delivering improved quarterly earnings, a science that certainly avoids being caught in the dogs assuming, of course, they have a clear cut exit strategy. There is another saying along the lines of “there are lies, damned lies, and statistics” and it’s easy to apply this to charts with arguments such as you choose a timeframe to support your argument and where you start the respective moves both having foundation but when corrections blow out they should not be ignored by any investor:

- In 2022 alone we saw SVB fall by -66%, Signature Bank -64%, and Credit Suisse -67% with the picture unfortunately far worse this year.

Financial markets have become increasingly risk-averse since central banks started raising interest rates and they’ve certainly been on point with the excessive leverage across some financial institutions – 15 years ago it was Bear Sterns and Lehman Brothers, today we simply have different elephants in the room but the authorities appear to have learned their lesson from the GFC i.e. stop contagion risks immediately!