What Matters Today in Markets: Listen Here each morning

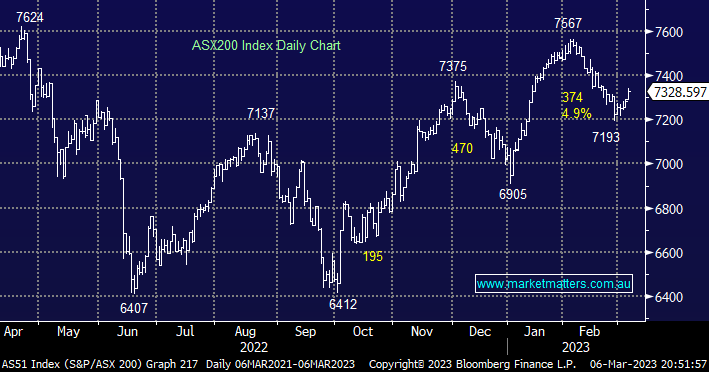

The ASX200 rallied +0.6% on Monday following a positive lead from Wall Street, the gains were broad-based with over 70% of the main board advancing which was made even more impressive by several stocks trading ex-dividend e.g. Bendigo Bank (BEN), Ramsay Healthcare (RHC) QBE Insurance (QBE) and Iluka (ILU). Ironically the day before the RBA’s set to hike rates for a 10th consecutive time the best-performing sectors were the interest-sensitive names, i.e. Consumer Discretionary +1.95%, Tech +1.8%, and Real Estate +1.7%.

- At 2.30 pm today the RBA is expected to hike interest rates by 0.25% to 3.6% – it’s already old news unless we see a change in the hawkish rhetoric from Philip Lowe.

The only standout areas of the market which struggled yesterday were generally China facing following the disappointing economic goals it announced over the weekend e.g. Fortescue (FMG) -2.5%, Whitehaven Coal (WHC) -2.1%, South32 (S32) -0.8%, RIO Tinto (RIO) -0.8% however considering the comments out of Beijing we felt the stocks held up pretty well. Historically when Beijing says they will stimulate they follow through on their talk hence when the implication is they won’t it’s not great news for our miners. Conversely, as we mentioned earlier some of the standout performances on Monday were delivered by the tech names e.g. Altium (ALU) +1.9%, Xero (XRO) +3.8%, and HUB24 (HUB) +4.73%.

- Our ideal scenario over the coming weeks/months is we see markets experience ongoing strength in the likes of tech and accompanying underperformance/weakness in the resources which will allow MM to switch our current overweight stance towards growth stocks back in the resources.

US stocks started the week with a choppy session which ultimately saw the S&P500 close up +0.1% after a disappointing last few hours but the SPI Futures are pointing to a -0.2% drop early on following a ~80c fall by BHP in the US – perhaps we are going to see a delayed reaction to Chinas growth news.