What Matters Today in Markets: Listen Here each morning

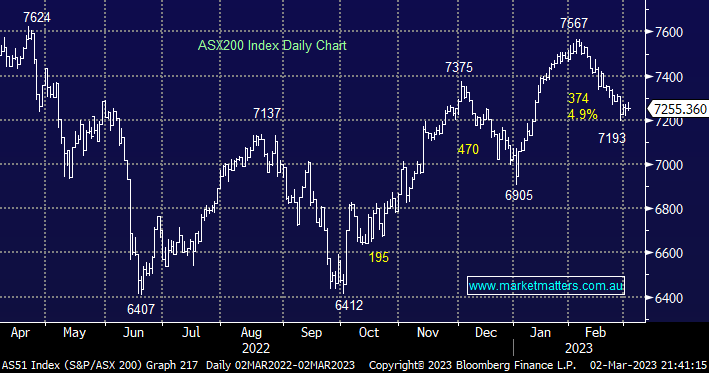

The ASX200 was held together on Thursday by a strong Resources Sector, we witnessed an arm wrestle between the market’s two most influential sectors, with the banks opposing the major miners, and the net result was effectively a draw with the index closing up just +3pts.

Winners: South32 (S32) +5.2%, Mineral Resources (MIN) +4.7%, Whitehaven Coal (WHC) +4.4%, and BHP Group (BHP) +4%.

Losers: ANZ Bank (ANZ) -2.7%, Macquarie Group (MQG) -2.1%, Commonwealth Bank (CBA) -2.0%, and Westpac (WBC) -1.95%.

We’ve been expecting a year where uncertain economic times would deliver volatility on the stock/sector level and the first two months have certainly delivered i.e. year to date over 30% of the ASX200 has rallied or fallen by over 10% with the winners trumping the losers by more than 2:1, a pretty good result considering reporting season held a slight bias towards the bears.

Fund managers appear to be very comfortable switching between stocks and sectors but there’s not a great deal of appetite towards increasing/decreasing overall market exposure – the latest Bank of America Fund Managers Survey showed cash levels remained at 5.2%, down from 5.3% in January. Although we suspect these levels might have again edged higher following the latest strong US economic data which sent bond yields higher.

US stocks closed higher overnight led by a resurgent tech space another total reversion to the previous 24 hours. The SPI Futures are pointing to a +0.4% rally early on by the ASX2200 with tech likely to be strong although the banks & resources might be quiet e.g. BHP Group (BHP) closed up ~20c in the US.

Firstly, we’ve taken a brief look at 3 holdings in the Flagship Growth Portfolio as they caught our attention yesterday for different reasons: