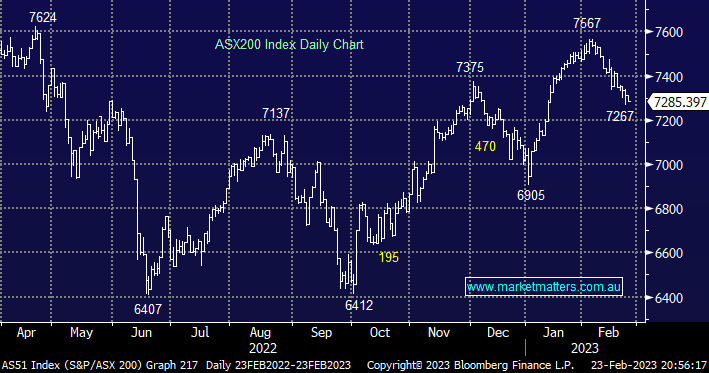

The ASX200 continues to face headwinds around the 7300 area but when we take into account what was thrown at the index yesterday the minor -0.4% pullback felt like a solid performance, the broad market actually rallied with nearly 60% of the main board finishing up on the day but when heavyweight BHP Group (BHP) tumbles -3.4% the result is almost inevitable – more on this and related names later.

Yesterday again saw Australian 3-year bond yields test the 3.6% area, less than 0.15% below their decade high – as we keep saying at MM if investors have a good handle on bonds and the $US they can add value/alpha to their portfolios through 2023/4. Short-dated Australian yields bottomed at 2.88% on January 27th before rallying more than +0.8% in just 5 weeks i.e. a meaningful three 0.25% rate hikes! The ASX200 initially managed to grind up +1% as yields crept higher (bond prices lower) but it didn’t take long for stocks to dance the money market jig i.e. Bonds and stocks traded lower in tandem. In our opinion, there are a couple of read-throughs from here that MM is keen for subscribers to comprehend.

- The RBA’s rhetoric is very hawkish today and if they can be believed the Cash Rate is headed from today’s 3.35% to over 4% this Financial Year.

- However MM believes the RBA is failing to look forward and the economic brakes will start to bite sooner rather than later which will have investors questioning the “hawks”.

- Stocks and bonds can again turn higher in the coming months if MM is ultimately correct e.g. we saw how much stocks enjoyed the weak wages data earlier this week.

Elsewhere it was disappointing to watch the +0.5% intra-day rally by US S&P500 futures ignored by the local market which ultimately closed near its lows, the ASX has lost its “Mojo” through February after running extremely hard in the first 5 weeks of 2023 i.e. the ASX200 surged +9.6% as the market embraced the notion that interest rates were close to reaching a pivot and would then start falling later in the year, Philip Lowe has certainly quickly extinguished this fire of optimism.

Overnight, US stocks rebounded sharply from an intraday sell-off led by the tech stocks, the Dow reversed 350 points from its low to close up +0.3%, and BHP is down another -1.2% in the US which is leading to the SPI only calling the ASX marginally higher.

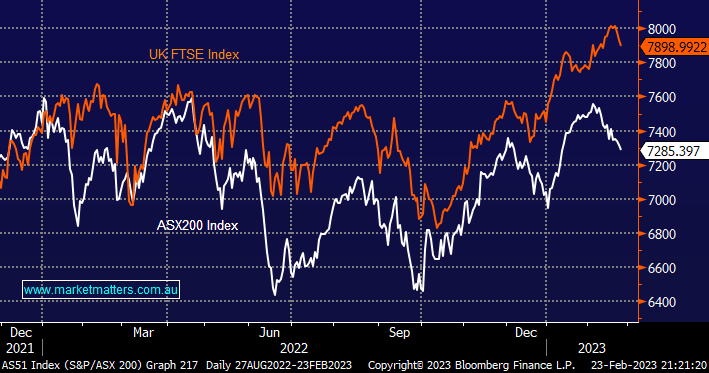

The ASX is usually highly correlated to European indices but over recent months the Australian index has been a laggard with European indices breaking to all-time highs while local stocks have been weighed down by an increasingly hawkish RBA. Unfortunately, we believe the ASX will underperform most of its peers until the RBA adopts a more open-minded stance i.e. in our opinion it’s not paying enough attention to the risks posed by the mortgage cliff approaching later this year.