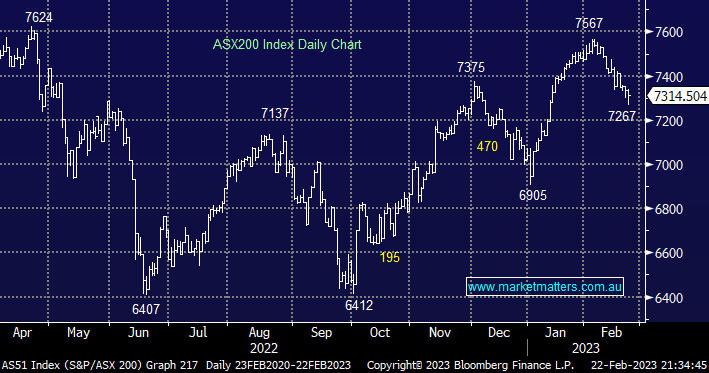

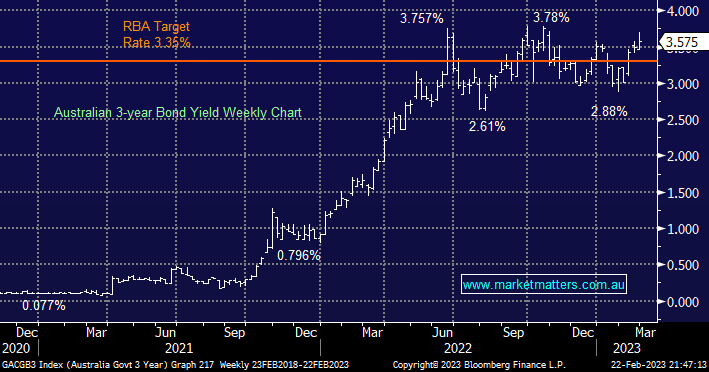

The ASX200 put in a brave performance yesterday closing down just -0.3% in the process shrugging off a -2% drop by the US S&P500 plus Commonwealth Bank (CBA) trading ex-dividend $2.10 fully franked. The catalyst for the market’s impressive intra-day recovery was the wage data released at 11.30 am which showed wages are rising far less than expected and importantly well below the current rate of inflation i.e. everyone’s already getting worse off without the help of the RBA! The reaction of money markets to these weak wage numbers questioned the RBA’s increasingly hawkish stance as local short-dated bond yields instantly dropped -0.15%.

- MM still believes the RBA is becoming increasingly hawkish just when they should be adopting a more cautious wait-and-see approach.

On the stock/sector level, Wednesday delivered more volatility courtesy of reporting season with Dominos Pizza (DMP) -23.8% and Origin Energy (ORG) +12.7% the standouts from both ends of the spectrum. However, after retreating exactly 300 points, or 4%, from its February high buyers appear to be slowly returning to the ASX with strong intra-day bounces from lows becoming commonplace.

- We like the market into current weakness with some rate-sensitive stocks likely to bounce if we see further deterioration in the local economy – it’s perverse but bad news is good for some stocks.

US stocks experienced a mixed session overnight with the S&P500 closing down just -0.1% however a -2.7% fall by BHP in the US weighed on the SPI Futures which are calling the ASX200 to open down -0.3% this morning.

The move by short-dated bond yields following yesterday’s wages data illustrates how fickle opinion has become around what the RBA will deliver next, one bad wages print and the 3 years fell 0.15% instantly paring back concerns around the path of rate hikes through early 2023.

- We are looking for ongoing signs that the Australian economy is going into hibernation which will eventually change the course of a stubborn RBA.