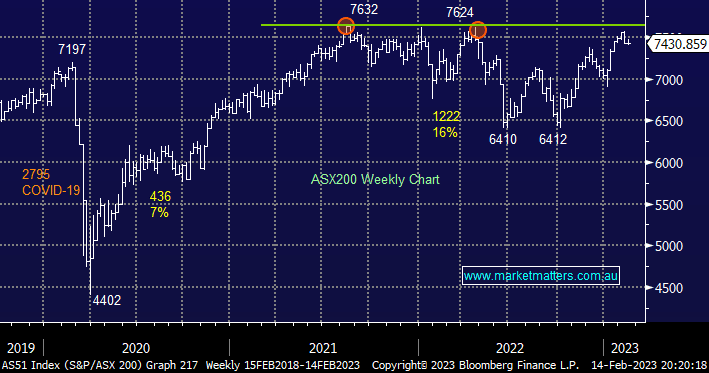

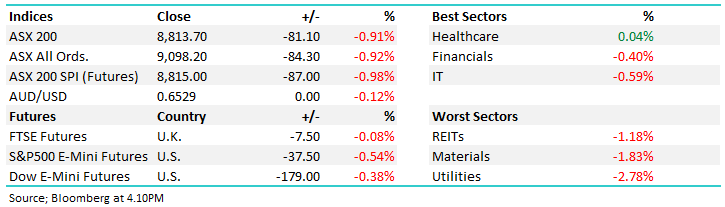

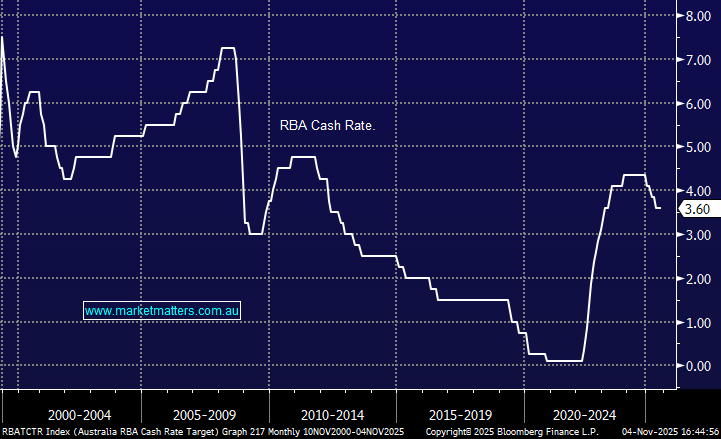

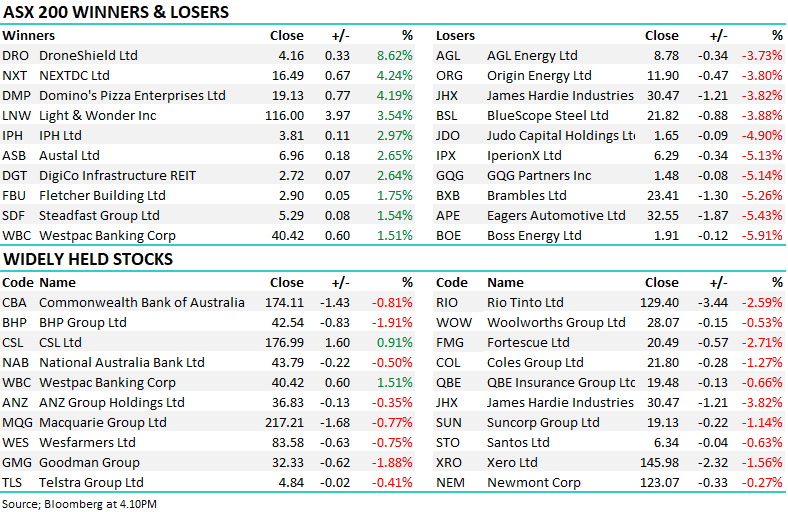

The ASX200 followed US indices higher at the start of Tuesday but from 10.30 am onwards it slowly but surely slipped lower losing almost 80% of its original gains, a couple of big hits on the stock level appeared to weigh on overall sentiment e.g. Star Entertainment (SGR) -13.5%, Ansell (ANN) -8.7% and Breville (BRG) -4.7%. Earnings season hasn’t helped a tired market that’s already rallied +18% from its October low, however, it’s been interest rate expectations that’s weighed heaviest on risk assets over recent weeks, yesterday we saw NAB forecast that the RBA would hike rates up to 4.1% and suddenly we have a new “handle” that is largely being accepted.

- MM is sticking with our 4% and 5% target for domestic and US official rates, but unfortunately, unless we see a surprising aggressive reversal by inflation/employment we cannot imagine central banks will risk cutting until 2024.

Yesterday saw one of MM’s holdings in our Flagship Growth Portfolio on the receiving end of a downgrade as rising interest rates take their toll on an already weak housing market. Margins at James Hardie (JHX) remain under pressure in all of its major markets which has led to the decision by the company to cut the global workforce by 6% – as subscribers know we continue to believe that slowly but surely employment data will start to soften.

- JHX downgraded its expected full-year income to $US600-620mn from $US650-710 – a downgrade of 10% in the middle of the range.

- however the market consensus before the announcement was $649m, i.e. just below the bottom end of the range. At the mid-point of the new guidance (~$610m), it was effectively only a 6% downgrade.

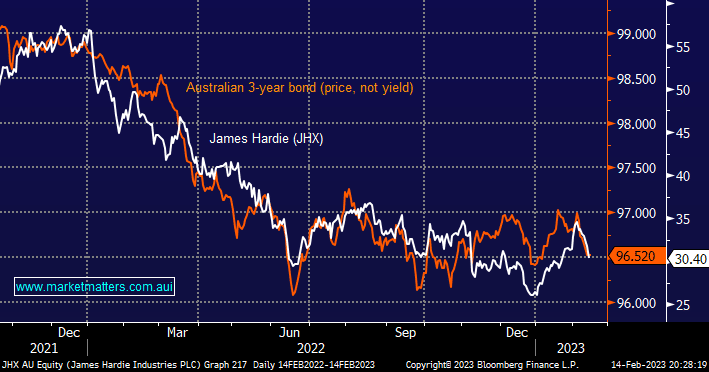

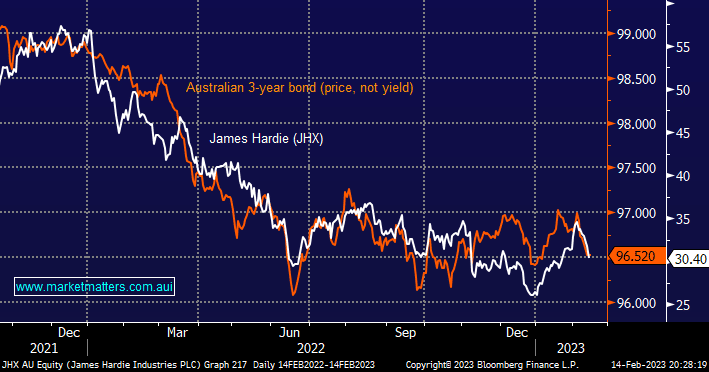

However, considering the building products company downgraded for the 3rd time in 12 months we felt the controlled -4.25% drop in its shares wasn’t too bad although as mentioned above it does reflect that most people originally believed it was being too optimistic in the first place i.e. the market was right! A very quick glance at the comparison of JHX’s fortunes over the last year illustrates how it’s highly correlated to short-term bonds, in this case, the Australian 3-years.

- We believe Australian 3-year bond yields have limited upside from current levels which bodes well for JHX.

Tuesday again saw ASX investors focus on stock-specific news as opposed to allocating money in/out of the index itself, a trend we believe will dominate much of 2023. On the sector level, it was a fairly quiet session although the tech names caught our attention rallying +1.3% into the important US inflation data, we still believe if interest rate shocks are kept to a minimum then growth stocks can enjoy a solid Q1 – the US market reflected this perfectly last night.

- The ASX200 is set to open unchanged this morning following a choppy session on Wall Street with growth stocks likely to be relatively strong.