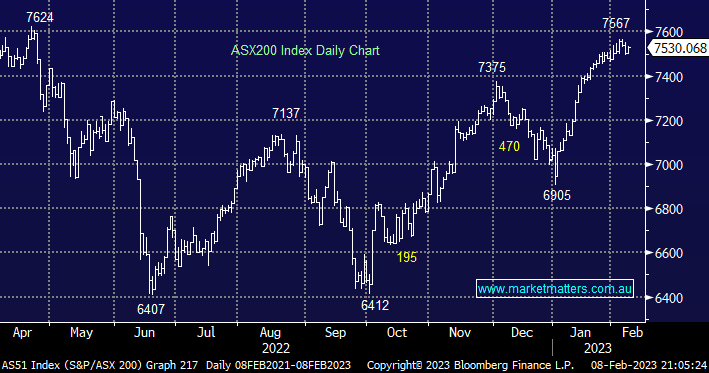

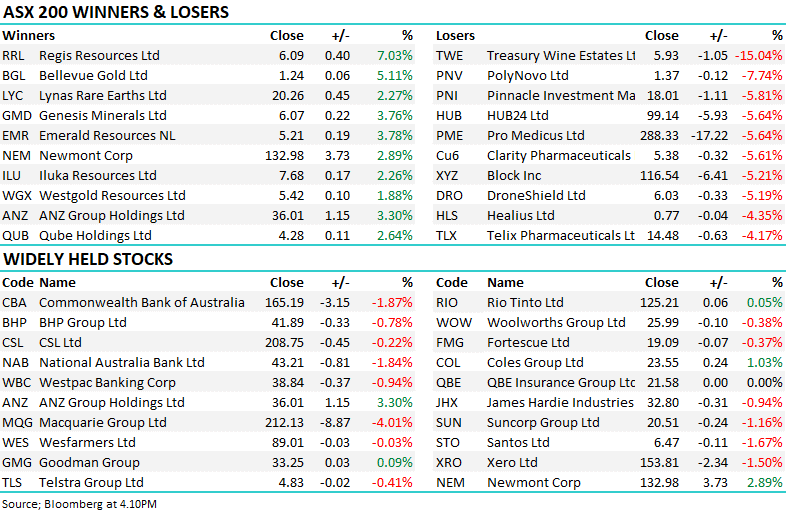

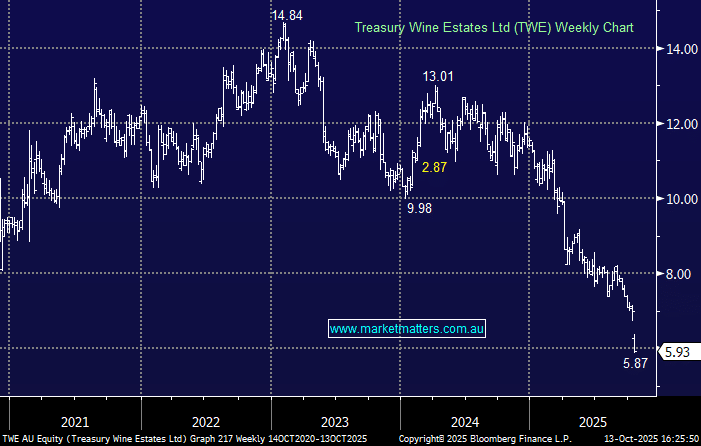

The ASX200 maintained its recent love affair with the 7500 area on Thursday finally closing up +0.35% with the influential financials offering the main support e.g. Suncorp (SUN) +4.6%, Macquarie Group (MQG) +2.6% and National Australia Bank (NAB) +1%. The winners and losers were evenly matched but it was the smaller end of the main index which dragged the chain hence the index managed to post a small gain e.g. Elders (ELD) -5.9%, Healius (HLS) -5.4% and United Malt Group (UMG) -4.1%.

The press might still be discussing the ramifications of the RBA’s latest rate hike but financial markets appear to have moved on fairly quickly with bond yields and the $A struggling to add to Tuesday’s gains following the hawkish comment from Dr Lowe. At MM we believe the RBA is dangerously close to compounding a bad year at the helm:

- The RBA has hiked rates at an unprecedented rate from 0.1% last April to 3.35% today i.e. they were way too slow in recognising inflation was brewing – they only had to ask anyone shopping at Woolies &/or attempting some household renovations!

- Now they’re getting increasingly hawkish just as 1000’s of people are losing their jobs, especially in the previously hot tech space, inflation is easing especially in the US and supply chain issues are returning to normal.

Mortgage holders who bought last year when fixed rates were on offer sub 2% are now really feeling the pain as the equivalent packages head towards/above 6%, I’m sure people who took the 3-5 year terms are feeling relieved. We feel the RBA is looking a little too closely at today’s data as opposed to what’s looming on the horizon i.e. they might well tighten to ~4% before quickly living to regret it.

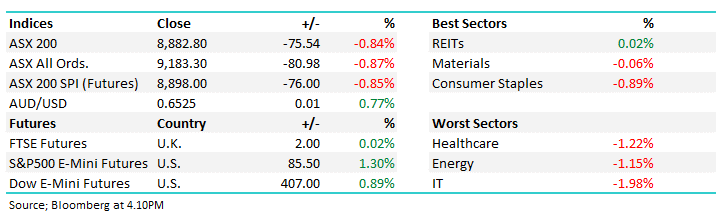

US indices slipped overnight as investors focused on the trajectory of interest rates, the markets are becoming increasingly fickle around day-to-day news after rallying strongly over recent months. The S%P500 closed down -1.1% while the European indices eked out small gains, the SPI Futures are pointing to a -0.4% dip early this morning, erasing yesterday’s gains in the process.