Dr Philip Lowe and the RBA slapped local markets yesterday, not with the much anticipated +0.25% rate hike to 3.35% but with the extremely hawkish/ominous accompanying rhetoric:

- “The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.” – rates are going higher.

- “The Board is seeking to return inflation to the 2–3 per cent range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one,” – recession risks are real.

- “In assessing how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.” – they’re not sure how much higher rates are going.

- “The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.” – don’t doubt that rates are going up.

Just a cursory glance at these 4 lines makes it obvious that the RBA isn’t going to back off anytime soon – they’ve let the inflation genie out of the bottle and they want it back in asap!

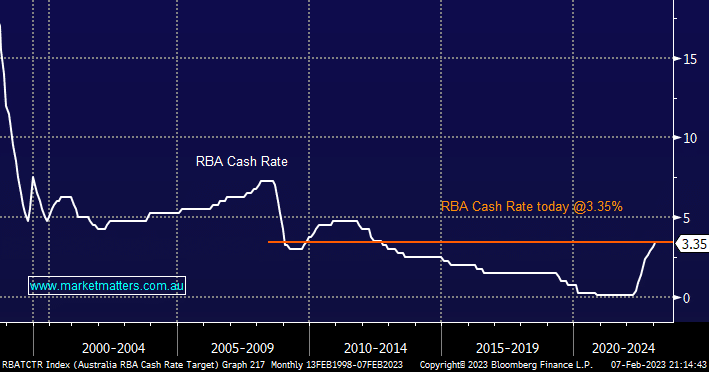

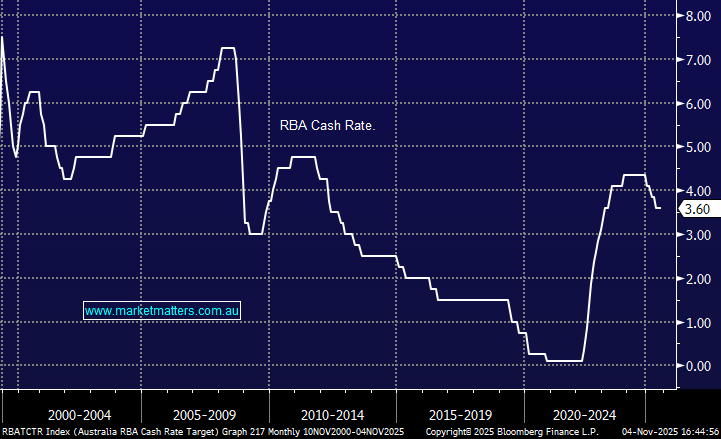

The painful 9th straight rate hike was built into the market but comments like the above have significantly increased the prospect of rates breaching 4% in 2023 e.g. 3-year bond yields rallied +0.15% yesterday. Amazingly just last April the official cash rate was at 0.1% making it easy to comprehend why many households are starting to hurt and become frustrated by the RBA – in late 2021 Dr Lowe stated rates would not rise until 2024 and just last February he said interest rates could “plausibly” lift-off later this year. The RBA were well off the mark with both of these comments which unfortunately many Australians both heard and paid heed to. The main ray of hope we read yesterday was by definition a 2-edged sword.

- “The Board recognises that monetary policy operates with a lag and that the full effect of the cumulative increase in interest rates is yet to be felt in mortgage payments,” – when people start to hurt they will stop hiking.

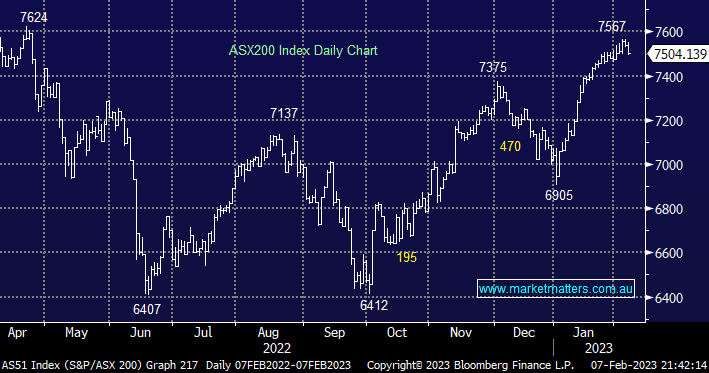

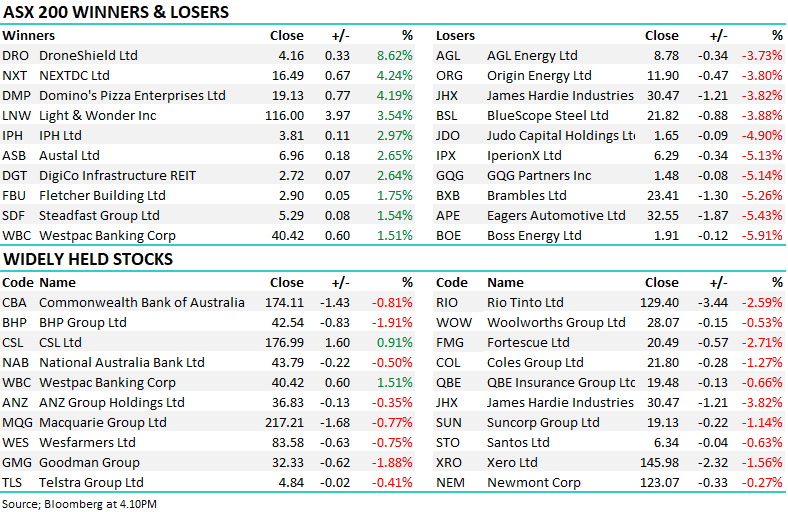

Tuesday was all about the RBA and the unexpected hawkish comments delivered by the RBA Governor. Stocks reversed lower in a matter of minutes after the 230pm decision as investors contemplated rates breaking above 4% before Christmas, the ASX200 finished the day down -0.5% on broad-based selling which saw less than 30% of stocks post gains.

- The ASX200 has rallied +9.6% from its January low, we believe the RBA commentary and the strong US Jobs Report on Friday are going to make it hard for the index to push higher from the 7500 area i.e. a pullback to at least 7400 wouldn’t surprise.

US stocks experienced a choppy session overnight following comments from Fed Chair Jerome Powell – he pointed to Friday’s very strong Jobs Report as a sign that higher rates were required though he was optimistic that inflation would slow i.e. something for the bulls and bears!

- After Powell’s comments Morgan Stanley lifted its peak target from 5% to 5.25%, and the US 2-year yield rallied slightly to 4.475%

- The Dow initially surged 350 points only to reverse over 470 points before ultimately closing up +256 points laying the platform for the ASX200 to open up around +0.5% this morning with growth stocks likely to perform the heavy lifting.