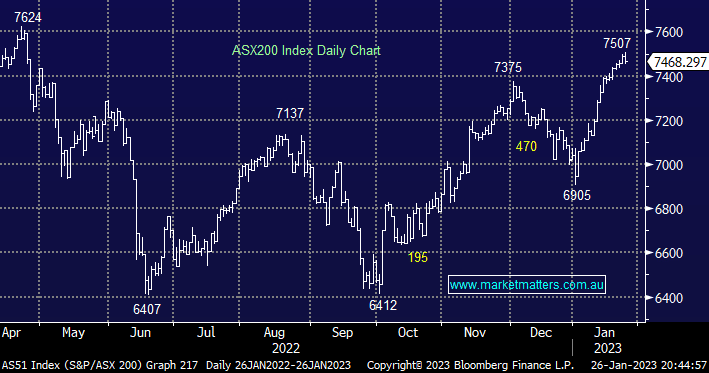

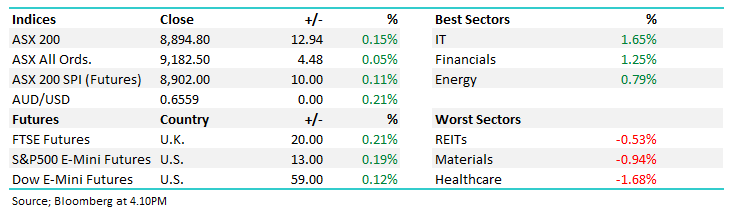

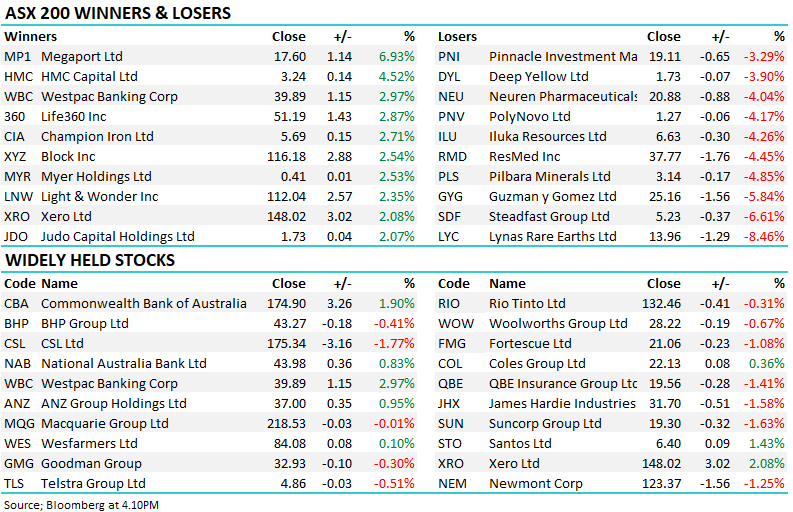

The ASX200 slipped 22-points into Australia Day following the fortunes of Microsoft (MSFT US) closely through the US late trading session i.e. MSFT opened up ~5% after its quarterly reports saw a beat on the EPS front however following a muted management presentation the stock reversed to be down -1%, taking the wind out of the sails of a previously strong local Tech Sector which ultimately closed down -1.2% after a promising start. Gold stocks also experienced some noticeable selling with Newcrest (NCM) and Evolution (EVN) both reversing lower after hitting fresh 7-month highs during the morning.

- Following the ASX200’s 600-point rally this month things are feeling a touch tired as some profit-taking appears to be lurking in the wind.

However, there was a secondary bearish influence involved on Wednesday, the Australian CPI data was released at 11.30 am with the numbers coming in significantly higher than expected i.e. the Quarter on Quarter CPI came in at 1.9% compared to expectations of 1.6%. Initially, the market plunged around 50 points after the disappointing numbers but slowly but surely the market recovered to close down just -0.3% demonstrating some resilience in the face of bad news.

- Wednesday’s CPI propelled local 3-year bond yields up almost 0.25% to 3.15%, and the $A well above 71c i.e. markets are betting the RBA will remain in hiking mode at their February meeting.

- Bond markets are now looking for a 9th consecutive hike next month with cuts now not looking unlikely until well into 2024.

US markets enjoyed a strong session overnight despite GDP numbers suggesting the risk of a recession this year remains very real, gains were led by the resurging tech-based NASDAQ which finally closed up +2% helped by standout performances from Tesla (TSLA US) +11%, eta Platforms (META US) +4.1% and Microsoft (MSFT US) +3.1%. The SPI Futures are pointing to an open by the ASX200 back above the 7500 area this morning, or up +0.6%.