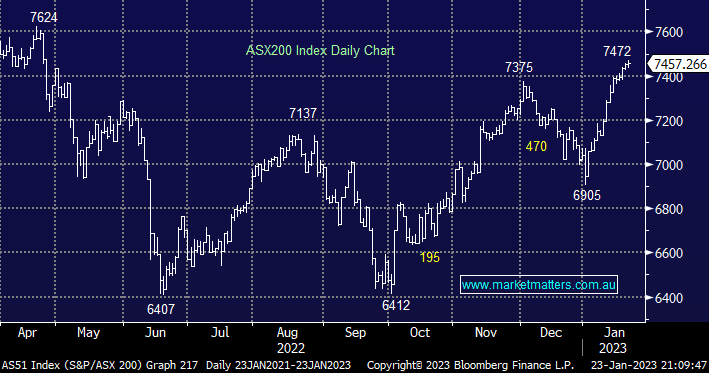

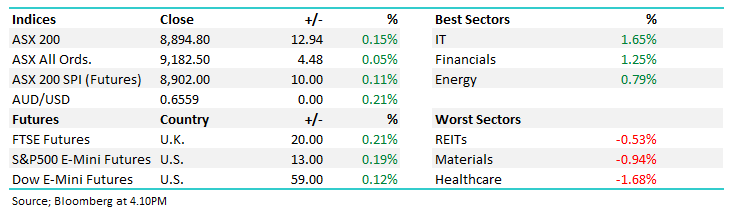

The ASX200 edged higher yesterday in quiet trading compounding its gains for 2023 to 6% after just 3 weeks of trading, the index was actually higher earlier in the day but some selling, most notably across iron ore names, was enough to see the index surrender 75% of the early advance. The broad-based market is starting to feel understandably tired after surging well over 1000 points in less than 4 months although the Tech Sector is finally attracting some buying as inflation fears subside.

- The local tech Sector was the best on the ground on Monday rallying +1.3% in a session where 5 of the 11 sectors actually fell.

- We are sticking to our guns believing that tech stocks will outperform through Q1 of 2023 as inflation fears recede.

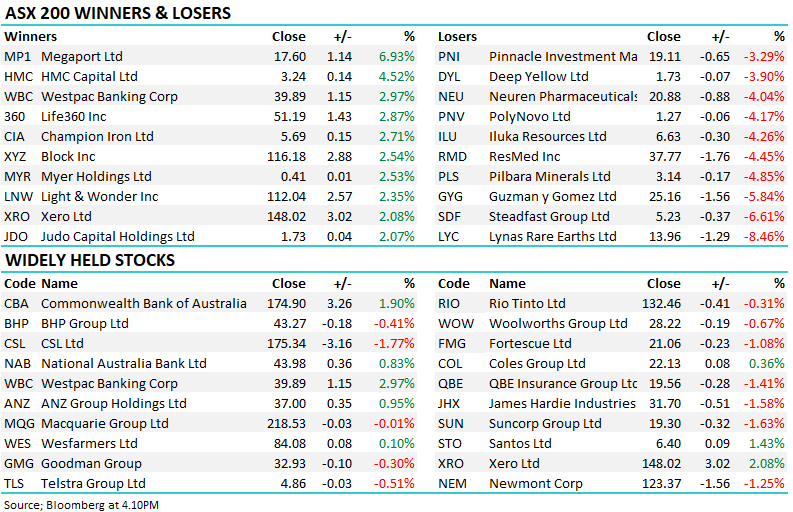

Another headwind for the index was delivered on Monday by Macquarie as they downgraded the influential Banking sector to underweight believing prices are already reflecting strong earnings while the chances of further upgrades are diminishing – their order of preference is ANZ, NAB, WBC and lastly CBA. In other words, they prefer the “cheaper” higher-yielding banks after the sector’s recent strong advances.

- At MM were only mildly bullish on the banks at current levels although fully franked yield in the 4-6% region is likely to be very supportive of weakness.

US markets rallied again overnight with the tech stocks leading the way – the Dow gained +0.8% whereas the NASDAQ soared +2.2%, its best 2-day run since November. As much of Asia celebrates the new lunar year of the rabbit investors have started buying the likes of Microsoft (MSFT US) and Tesla (TSLA US) ahead of their earnings reports, the entrenched pessimism is started to wane as the businesses shift focus to cost-cutting as inflation worries start to fade. The SPI Futures are pointing to a +0.3% open by the ASX200 with BHP trading slightly lower in the US.