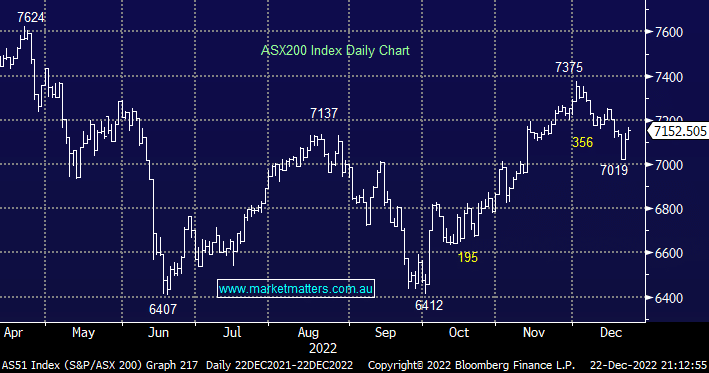

The ASX200 finally strung together two consecutive positive days courtesy of strong performances from overseas bourses, in quick fashion the local index had bounced almost 150 points, recovering more than 40% of December’s losses in the process – it’s, unfortunately, going to be a different story this morning. Thursday’s gains were fairly broad-based with over 75% of the index rallying with only the Resources Sector surrendering a little ground. A number of the growth stocks caught our attention in the winner’s enclosure as bond yields continue to consolidate their strong advance through 2022:

Growth stocks in MM’s portfolio: Seek (SEK) +3.5%, REA Group (REA) +2.3%, Altium (ALU) +2%, HUB24 (HUB) +1.6% and Xero (XRO) +1.6%.

It does remain our intention to reduce our overweight stance towards these names in our Flagship Growth Portfolio at some point – preferably at higher levels, however, we are firmly on the sell side as we discuss in this week’s Portfolio Positioning Webinar – Watch Here

Conversely, the recent high flyers struggled yesterday with many gold, lithium and coal names amongst the worst performers as fund managers tweaked their portfolios into the end of the year.

US stocks were sold off overnight following strong economic data which supported the Fed’s view that the economy is strong enough to withstand further rate hikes. In line with the strong economic read, the interest rate sensitive US two-years climbed to 4.25% and the $US recovered +0.4%, back towards 104.5, the S&P500 closed down -1.4%, having been down over 3% at its worst. Following the weak session on Wall Street, the SPI Futures are calling the ASX200 to open down around 66 points this morning.

- We are now 50-50 towards the ASX200 into Q1 of 2023.