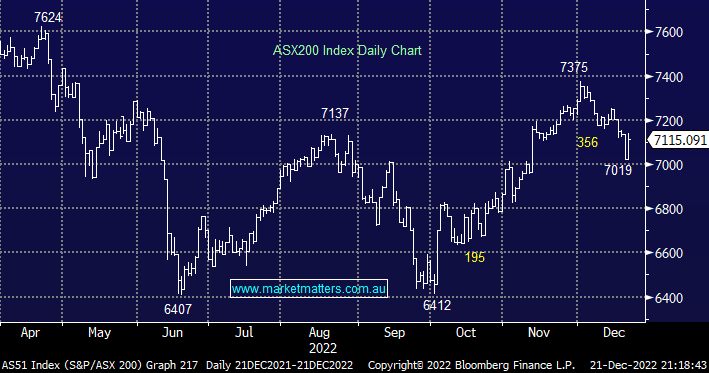

The ASX200 has embraced the saying “what a difference a day makes” in consummate style over the last 48 hours i.e. down aggressively on Tuesday following the BoJ’s hawkish tweak on interest rate policy followed by a +1.3% recovery yesterday, the net difference being down just 18 points. The local market’s advance yesterday was broad-based with over 85% of the main board rising as the bulls again started talking up the prospects of a late Christmas rally – certainly, anything is possible as volumes start to decline. There were a few standout sector performances as the news from Japan was dismissed almost as fast as it arrived:

- Gold stocks surged to multi-month highs – Evolution Mining (EVN) +8.1%, Silver Lake Resources (SLR) +7.8%, Newcrest Mining (NCM) +6.5% and Northern Star (NST) +4%.

- The Energy Sector remains strong – Whitehaven Coal (WHC) +4.5%, Karoon Energy (KAR) +4.2% and Woodside Energy (WDS) +2.7%.

- When bond yields fall banks feel heavy but real estate gets a bid e.g. all 26 members of the Real Estate Sector rallied yesterday.

- Tech stocks still aren’t convinced the inflation/yields can help them rally e.g. Xero (XRO) +2.4%, Seek (SEK) +0.8% and Altium (ALU) +0.4%.

Our strategic stance hasn’t changed, we are looking to migrate down the risk curve into Q1 of 2023, ideally into a strength over the coming days/weeks.

- MM is in “sell mode” looking to increase our flexibility for what looks set to be another exciting year ahead.

- Remember through 2022 how quickly cycles have contracted in duration e.g. in just 3 months’ time coal might be out of favour and lithium back in i.e. remain open-minded.

US stocks rallied strongly overnight on a rare occurrence led by tech names as sentiment improved towards riskier stocks e.g. Apple Inc (AAPL US) +2.4%, Amazon (AMZN US) +1.9% and Netflix (NFLX) +3.4%. The S&P500 ultimately closed up 1.5%, helping the SPI Futures point to the local index gaining around 40 points on the opening this morning.

- We feel the ASX200 can regain some recently lost ground into year-end but a test of 7400 now feels too optimistic.