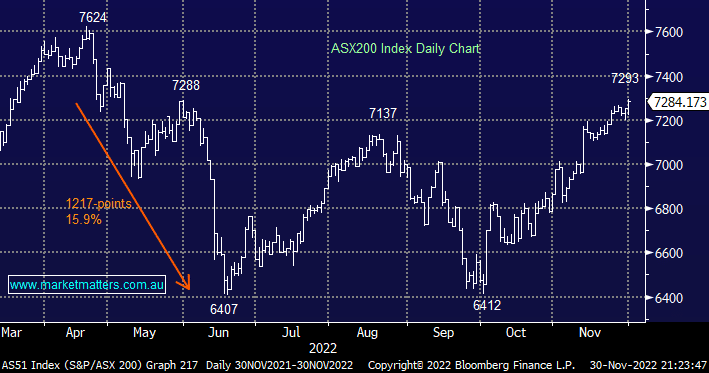

The ASX200 rallied another +0.4% yesterday taking it within striking distance of the psychological 7300 level, amazingly only 4.5% below its all-time and that’s before we take into account dividends, in just one month November has delivered gains of +6.75% (including dividends) defying numerous bears in a relentless march higher. Wednesday followed the trend of the month with moves being dominated by the Resources Sector which surged +16.3% in November, only beaten by the Utilities which gained over +20% but from an index perspective it was the large-cap resources that drove the Australian index higher:

- Novembers gains: BHP Group (BHP) +21%, Evolution Mining (EVN) +29%, Fortescue (FMG )+31%, RIO Tinto (RIO) +24% and Sandfire Resources (SFR) +43%.

More on a couple of these later as we hone in on a few stocks/themes covered by Resource Analysts Peter O’Connor in yesterday’s Market Matters hosted Resources Webinar, great timing as the sector pushes ever higher – a recording is attached above for those that missed it or would like to view a replay. Outside of the resources, the market keeps toying with the idea of buying tech only to disappoint but with our September purchase of Seek (SEK) currently showing a paper profit of over 11%, there clearly is some buying percolating through some growth names within the overall market strength.

The main driver of buying on Wednesday was a low inflation print which eased fears on the domestic interest rate front, the CPI came in at 6.9% versus expectations for 7.6%. The RBA’s expectations have been that inflation will exceed 8%, so yesterday’s lower read may see some revisions as to the level of “peak inflation”, we could see the RBA reduce the pace of rate hikes although we must caution the RBA by their own admission haven’t been too hot at picking inflation post-Covid.

US equities rallied strongly overnight after Jerome Powell (Fed Chair) signalled a likely slowdown in the pace of rate hikes as early as this month, S&P500 reversed higher to deliver its longest winning streak in 16 months with large tech names leading the charge as bond yields and the $US fell on the more dovish news – “The time for moderating the pace of rate increases may come as soon as the December meeting”. The SPI Futures are targeting a +0.7% gain early this morning, an opening well above 7300.

- MM is cautiously bullish on the ASX200 into Christmas but we feel the “easy money” is behind us on the index level but not necessarily so for specific stocks/sectors.