The ASX200 pushed up another 108-points last week helped by solid performances from the unsung heroes in the Utilities and Real Estate Sectors while on the stock level it was a mixed bag while the lithium & ESG stocks experienced some fairly aggressive profit taking – falls are not always “profit taking” but the ESG stocks have run so hard in 2022 that the strong likelihood is most of the selling has resulted in a positive contribution to investors bottom line.

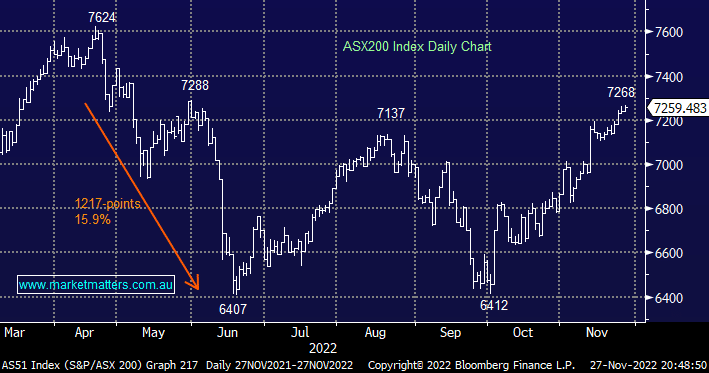

- No change, we still believe Australian equities can rally into Christmas but it’s hard to imagine a significant upside move from current levels with all-time highs now only ~5% away.

- If we see a sharp dip below 7100 the risk/reward will again look attractive for short-term players into Christmas.