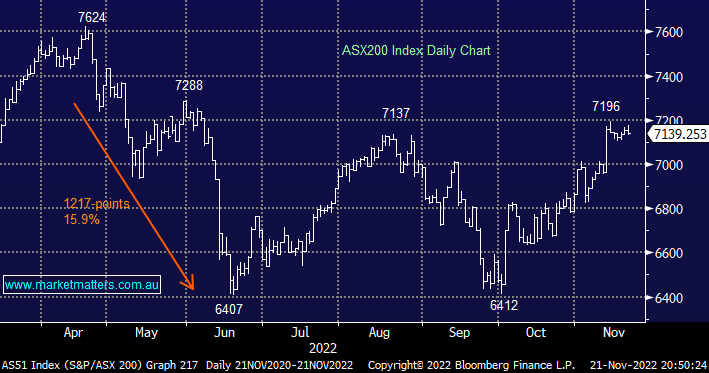

The ASX200 experienced a quiet start to the penultimate week of November which saw winners and losers match each other almost perfectly, the index ultimately slipped -0.2% to add to the consolidation of the market since testing 7200 last week. The ongoing sector rotation continues in a predictable fashion depending on strength/weakness in bond yields and the $US. Yesterday saw the $US kick up almost 1% leading to a very clear group of winners and losers which are likely to be reversed if/when we see the Greenback dip back under 107:

Winners: The Banks, Food, ESG names, and Defensives.

Losers: Diversified Financials, Oil, Resources, and Tech.

The market continues to follow the MM script through November although unfortunately, we’re now looking for a fairly boring period of consolidation, the last 6-days have seen almost no movement on the index level, and if we are correct when it breaks either above 7200, or below 7100, it’s unlikely to follow through in a meaningful fashion i.e. if MM were short term traders we would be fading strength and buying weakness but as “Active Investors” our current leaning is to migrate down the risk curve as equities push towards Christmas.

US equities recovered solidly from early losses following Fed officials indicating that a terminal rate of 5%, or higher, was likely in 2023. The index initially drove lower before bouncing to finish down -0.4% with Consumer Discretionary and Energy the worst performing sectors, however the SPI Futures have closed up over 30-points pointing to a gain by the ASX200 of +0.45% early this morning, remaining within striking distance of 7200.

- MM remains mildly bullish on the ASX200 into Christmas but the “easy money” is behind us.