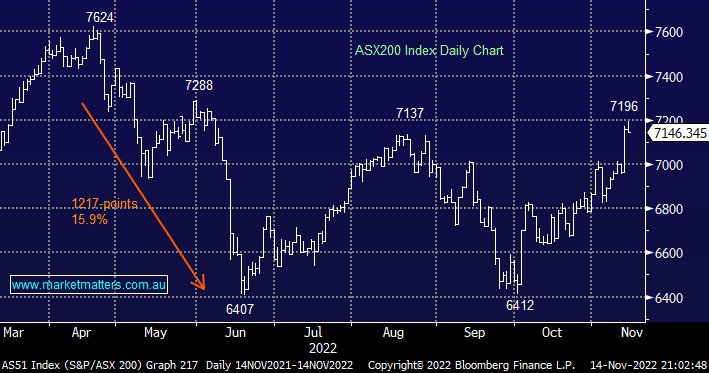

The ASX200 slipped -0.2% on Monday after testing our much-flagged 7200 target level in the morning, the simple problem was the broad market was soft with only 30% on the main index managing to close in positive territory. On the sector front, only the Energy & Materials Sectors closed higher while the tech stocks in particular disappointed after a strong performance by the NASDAQ on Friday night although the intra-day sentiment wasn’t helped by US stock Futures drifting lower throughout our day session. As we’ve been saying a bit of late it was yet another day of two halves:

Winners: Fortescue Metals (FMG) +10.1%, Iluka Resources (ILU) +6.6%, BHP Group (BHP) +4.6%, and Sandfire Resources (SFR) +3.2%.

Losers: ANZ Bank (ANZ) -1.5%, Coles Group (COL) -2%, Cochlear (COH) -4.2%, QBE Insurance (QBE) -4%, and CSL Ltd (CSL) -2%.

Companies that enjoy $US earnings and/or rising interest rates have started to garner sellers’ attention but conversely, the buyers only really got excited about the prospect of China’s property rescue package and apparent loosening of Covid-zero policies – Chinese stocks in Hong Kong extended their gains from October low to +20%. At this stage, the ASX simply felt tired on Monday after soaring over 500-points in just 3 weeks but we are mindful that stocks can surprise in both directions:

- MM is very conscious that back in October when “doom & gloom” dominated the press we turned bullish calling local and Asian indices to bounce as they have, the question now is what’s left in the tank?

- Only US equities are noticeably dragging the chain as “big tech” struggles to regain its mojo, we believe it’s likely to ultimately be successful but it’s not happening quickly!

US equities failed to rally overnight after dovish comments from the Fed Vice Chair who said it would “soon” be appropriate for the central banks to slow the pace of its rate hikes, plus this week’s meeting between Xi Jinping and Joe Biden can only be considered as a positive in our opinion i.e. the market feels tired. The S&P500 ended a choppy session down -0.5% after a weak close which has the SPI Futures also pointing to a -0.5% drop by the ASX200 early this morning.

- MM still believes the ASX200 is bullish into Christmas but the “easy money” is behind us.