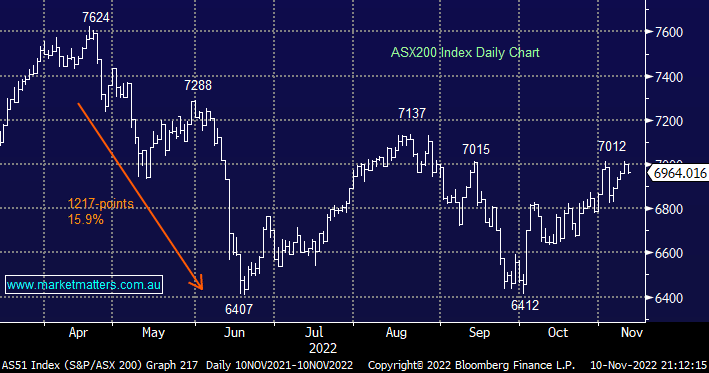

The ASX200 slipped -0.5% on Thursday as a clear break of the 7000 level continued to be one step too far – until this morning! Selling was fairly broad-based yesterday with 65% of the index closing in the red although weakness was noticeable in the influential Resources, IT, and Banking Sectors. However, considering the US market had fallen over 2%, the night before, under the combined weight of inconclusive mid-terms, poor corporate reports, and a tumbling crypto market we felt the performance was ok.

- We are only looking for another +3.5% upside over the coming weeks hence the current market rhythm appears likely to continue i.e. a choppy advance with plenty of down days in the mix but surprises are expected to be on the upside.

The main part of the puzzle still missing for MM as we approach mid-November has been a clear pullback in bond yields to ignite growth in stocks and in particular tech. This week US inflation data was always going to the next opportunity to see if central banks are winning their fight against inflation, hence it’s likely to be a large factor in determining the short-term direction of global interest rates:

- Overnight the US CPI came in at 7.7%, the lowest since January, tomorrow the University of Michigan’s 5-10 year inflation expectations will also be watched very carefully – so far so good!

US equities spiked the most in 2 years following the softer CPI number as growth stocks really got the bit between their teeth – Consumer Discretionary +7.7%, Tech +8.3%, and Real Estate +7.8%. Bond yields and the $US fell as would be expected setting the foundation for a strong day for the local market, the SPI Futures are pointing to a +2.7% rally on the open, straight back above the 7100 level where we haven’t ventured since late August.

- MM still believes the ASX200 is set to test the 7200 area into Christmas with any surprises still likely to be on the upside.