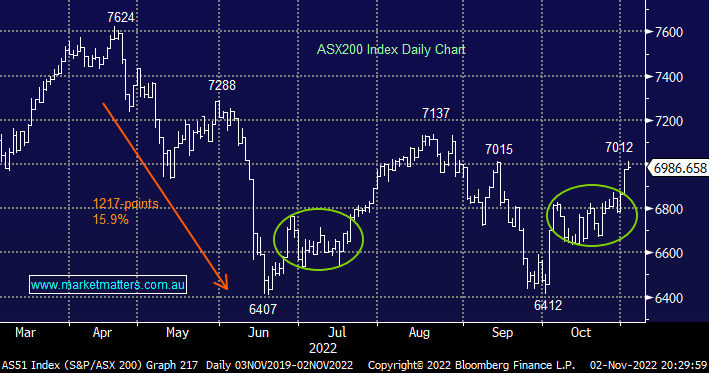

Wednesday saw the ASX200 manage to shrug off weakness across US indices and instead focus on a healthy Asian region, it’s been a while since local stocks went looking for good news but two consecutive 0.25% rate hikes by the RBA when many expected/feared 0.5% moves appears to have been just the required tonic to awaken the bulls. Admittedly the market felt tired yesterday morning as it tested the psychological 7000 level and we shouldn’t disregard how far it has rallied in just one month:

- MM has been targeting a rally to the 7200 area since we tested 6400 back in early October – local stocks have already rallied 600-points or 75% of our expectation.

- While we remain bullish into Christmas the risk/reward has clearly diminished and we will be cautious with further high-beta portfolio tweaks unless we see stocks dip through November.

Interestingly on the seasonal front, the first half of November is usually fairly average before equities rally strongly into Christmas hence when we combine this with how far stocks have already run since early October we are happy to stay long but wouldn’t be advocating migrating further up the risk curve in the short term. If we see some further volatility over the coming weeks it’s likely to produce some opportunities which we will consider at the respective time – the Fed might already have helped us here!

US equities went on a roller coaster ride overnight after the Fed hiked rates another 0.75% and Jerome Powell delivered a mixed message on what comes next – “rate peak has risen but the pace of hikes could slow”. The S&P500 swung around in a huge 3.6% range before settling in the bear’s corner down -2.5%, clearly interpreting comments from the Fed as more hawkish than is desirable. The SPI Futures are calling for the ASX200 to open down over 100-points, or -1.6%.

- MM still believes the ASX200 is set to test the 7200 area into Christmas with any surprises likely to be on the upside.