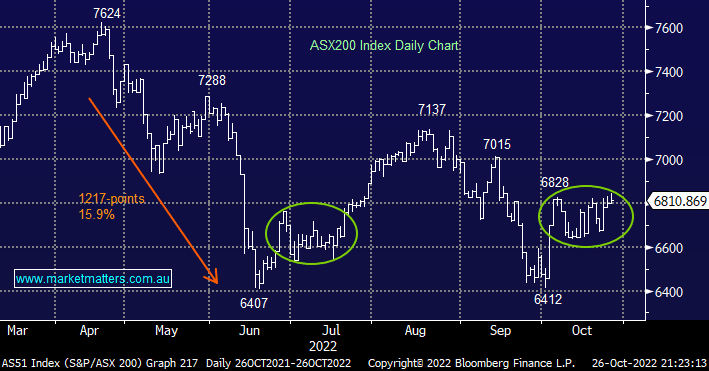

The ASX200 is starting to shrug off bad news as was evident yesterday when the local index gained +0.2% in the face of bearish news on both the Australian economy and the US corporate front:

- Australian inflation data again shocked on the upside with the headline CPI coming in at +1.8% quarter on quarter, well above the 1.6% expected – just wait until the power bills start surging!

- Local inflation is at its highest level since Paul Keating was battling inflation back in the early ‘90’s when we saw the cash rate hit an amazing 18% – today’s 2.6% is clearly irrelevant in comparison.

However even as inflation yet again surprised on the upside, the expected knee-jerk reaction across financial markets was conspicuous by its absence as bond yields, equities and the $A hardly blinked an eye, if anything they reacted as if the reading came in softer than expected with bond yields falling and equities rallying. As MM often expounds a market that rallies on bad news is a strong market or in today’s case one which is gaining traction as the selling exhausts itself. Interestingly, last night the Bank of Canada (BOC) surprised markets by slowing the pace of interest rate hikes while the talk clearly mellowed, “The tightening phase will draw to a close. We are getting closer, but we aren’t there yet”.

- US heavyweights Alphabet (GOOGL US) and Microsoft (MSFT US) fell after their quarterly updates showed slowing growth, when the ASX closed they were down around 7% and 8% respectively – it got slightly worse overnight.

- similarly the tech-based NASDAQ futures tumbled -1.5% in anticipation of a looming tough session which did unfold as neither stock managed to recover these losses.

However not only did our market rally but the local Tech Sector managed to close unchanged in the face of adversity – no change to our view that stocks are about to break out on the upside.

US equities experienced a choppy session with the positive news from Canada buoying sentiment but the weakness across the heavyweight tech names prevailed sending the S&P500 down -0.7% although the Dow did manage to close just in positive territory. The SPI futures are pointing to another rally early today of ~0.4% with the resources likely to contribute the most.

- MM still believes the ASX200 is set to test the 7200 area into Christmas.