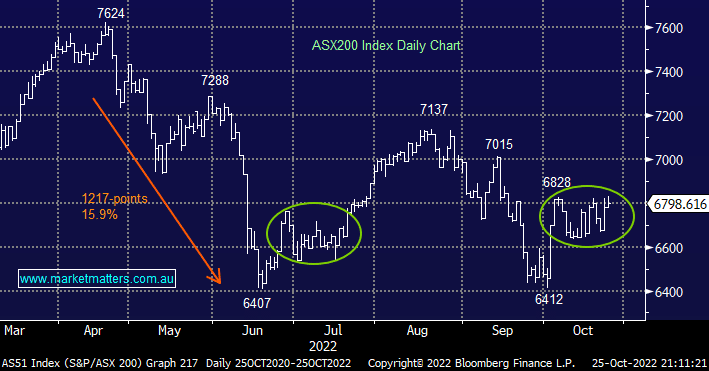

The ASX200 rallied another +0.3% on Tuesday as it continues to toy with the psychological 6800 area, as we’ve said previously the market set-up is evolving with an uncanny resemblance to its look & feel through late June, into July. Four months ago once the consolidation was over the market rallied strongly without a backward glance, we are currently wary that many investors are too pre-occupied with the Fed’s interest rate decision and rhetoric next Tuesday when a more pragmatic and aggressive position towards stocks feels warranted as the current wave of selling appears to have exhausted itself.

- MM is looking for the ASX200 to break out to the upside sooner rather than later

Earlier this month we saw the RBA hike rates by only 0.25% when most pundits thought they would go 0.5%, this bold move and in our opinion, sensible move by Philip Lowe et al suggests that local bond yields are close to an inflection point and the inversely correlated rate sensitive stocks/sectors a decent bottom e.g. Tech, Consumer Discretionary, and Real Estate. At MM we’ve stuck to our contrarian view that equities will be higher come Christmas, led by the high Beta Tech Sector, and last night’s Budget reiterated what we’ve suspected for a while:

- The Australian economy is losing momentum fast, it could be said that Treasurer Jim Chalmers has caught more than a hot potato.

- The relatively new Albanese government has warned of hard days to come including tax hikes and spending increases.

If things are looking as economically gloomy as both MM and the government believe into 2023, and beyond, it’s really hard to imagine the RBA hiking interest rates significantly higher than today’s 2.6% cash rate. Hence we can see a relief rally in stocks/sectors that have been weighed down by surging inflation and interest rates. In simple English, we believe investors have become too pessimistic towards risk assets as bond yields reverse their multi-decade bear trend – at least into early 2023.

Hence taking into account our strong view towards equities today’s report has focused on our favourite 3 stocks/positions for each of our 5 respective portfolios – we’ve not paid attention to our current holdings, weightings &/or entry levels it’s all about if MM was 100% in cash what are our 3 top picks today as we look for a strong rally into Christmas, and early 2023.