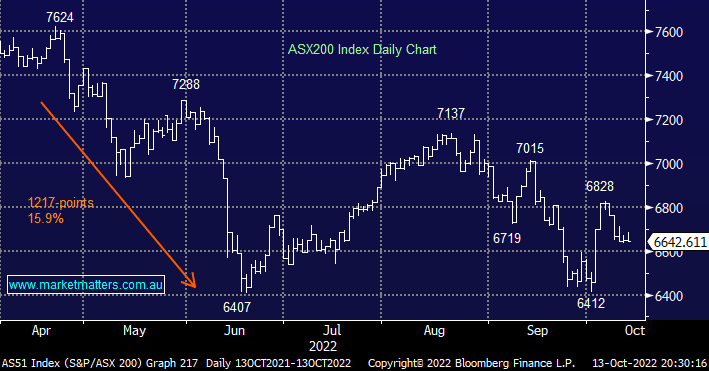

The ASX200 tried to rally yesterday but nerves ahead of the pending US CPI crept in after midday and the market surrendered its earlier 40-point advance. There were a couple of fascinating moves within the Resources Sector which could just be the start of some meaningful changes to some entrenched trends of 2022, it smells like “the game is afoot”:

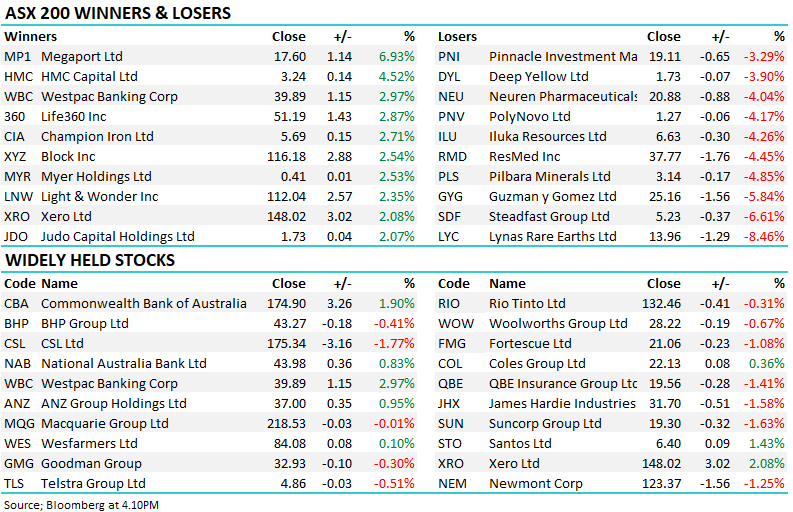

- Resources – the gold stocks rallied while the battery metals continued to drift lower, more on the latter in the 2nd half of today’s report.

Elsewhere markets were quiet with bonds and currencies all taking a well-earned rest ahead of the CPI, a figure which could easily set the trend both into and out of the next months Fed rate decision. At MM we believe the picture is slowly transforming to a less hawkish environment as previous rate hikes start to slowly weigh on consumers although the major storm clouds feel unlikely to challenge markets into later 2023:

- More than 90% of economies have now seen lower inflation over the last 3-months than the previous three – one decent print could unleash the bulls.

- Supply chain pressures are easing fast i.e. backlogs, delivery times, inventories and freight costs are all showing significant improvement – even 2nd hand cars in the US are starting to fall in price.

- Central bank policies are already showing signs of being restrictive with classic over tightening feeling a distinct possibility even with todays inflation levels still a real problem.

US equities roared higher overnight after an initial dip following the US CPI print showed the annual inflation rate eased for the 3rd straight month to 8.2% in September, down from 8.3% in August. However analysts were expecting an even lower read of 8.1% hence stocks initially fell hard before an encouraging aggressive turnaround saw another hot inflation print result in stocks soaring 5% from their lows as “expect the unexpected” continues to dominate in 2022. The SPI Futures are pointing to 3-figure gain early this morning taking the index back towards the 6750 area in the process.

- MM believes the ASX200 is set to test the 7200 area into Christmas, after the latest dip now ~8% away.