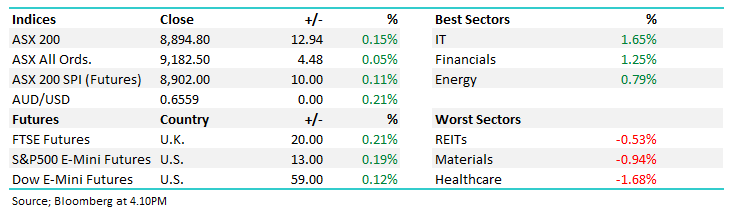

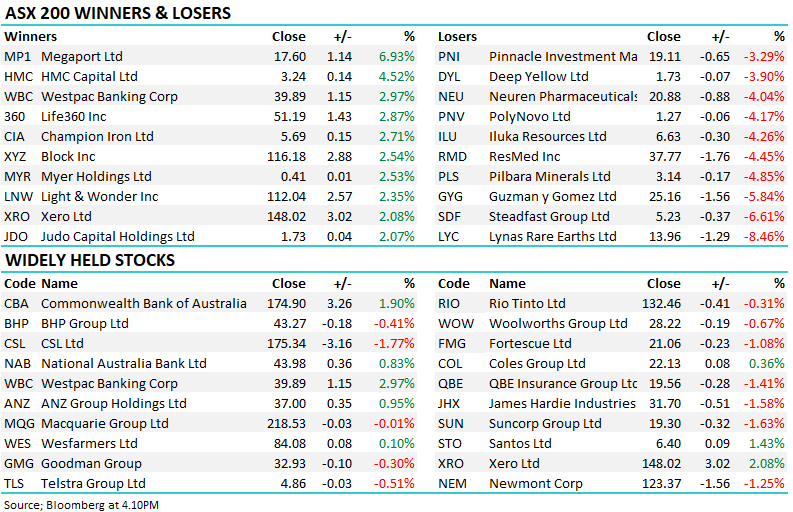

The ASX200 managed to ignore overnight wobbles on Wall Street to close marginally higher on Wednesday courtesy of a stellar session for the banks following an extremely bullish interpretation of the Bank of Queensland’s (BOQ) FY22 result – cash earnings were actually ~1% below consensus but the net interest margin was 2.5% above expectations, costs were lower while the top line increased, the board talked a solid game over the medium-term and as we’ve been discussing over recent weeks there appeared few people left to sell after the regional banks already corrected 35% over the last year, while the market is clearly underweight the sector. UBS upgraded a few banks last week while CSLA & JP Morgan have turned more positive this morning.

- MM has quoted on a number of occasions over the years “we don’t go down without the banks” and that was very evident yesterday with NAB the worst of the “Big 4” still rallying +1.3%.

Elsewhere the resources and in particular oil stocks weighed on the index with some well-known names receiving some attention from the sellers as recession fears mount and perhaps we also saw a little switching back into the banks e.g. Santos (STO) -2.5%, Minerals Resources (MIN) -3.7%, RIO Tinto (RIO) -1.9% and BHP Group (BHP) -1%. However the Property Sector really caught our attention rallying almost 1% ignoring the deluge of bad news crossing our screens in the process – anybody getting too close to today’s stock market will be chopped to pieces as traders so avidly put it, trends are becoming harder to pick with rising volatility the new norm.

- MM believes this is the time to form an opinion for the next 3-6 months, position oneself accordingly and then sit back, be patient, and see if it plays out through Q4 and beyond.

US equities experienced yet another choppy session overnight as they await their looming CPI (inflation) data, the minutes of the last Fed meeting showed officials were committed to tightening policy but “calibration” was needed – US 10-years yields dipped back to 3.9% on the news while stocks initially edged higher albeit in unconvincing fashion. The UK market was again weak falling -0.9% as the government’s policies are clearly creating a lack of confidence towards the country’s next chapter. Ultimately the S&P500 closed down -0.3 % and the SPI Futures are pointing to a dip of similar magnitude early on this morning.

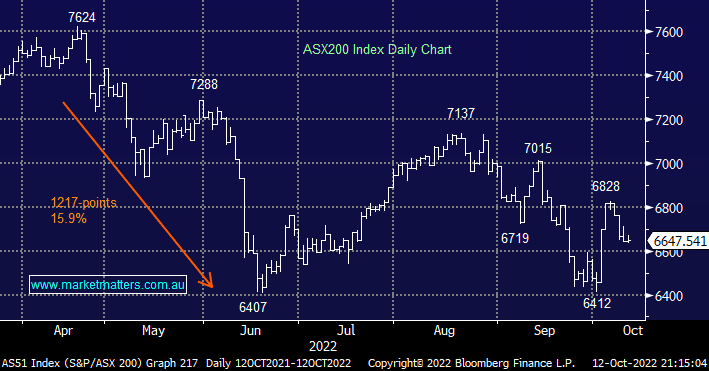

- MM believes the ASX200 is set to test the 7200 area into Christmas, after the latest dip now ~8% away.