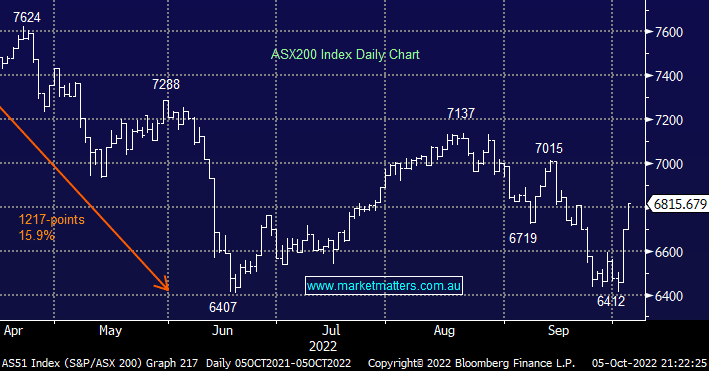

The ASX200 enjoyed another major “risk on” session on Wednesday, we even saw weakness in the US futures ignored throughout our day session as small intra-day dips were bought before they hardly started – no great surprise to MM when we consider how bearish investors & fund managers had become. Readers should remember that last month’s Bank of Americas Fund Managers Survey showed Fund Managers were holding their lowest ever allocation to global equities, or in other words, as we’ve been pointing out who will be left to sell. However, we caution subscribers around becoming too bullish into strength:

- MM is only targeting a rally up towards the 7150-7200 area, now only 6% away while “Auld Lang Syne” won’t be sung for another 14-weeks i.e. the start of 2023.

- Even the aggressive short covering rally into August’s 7137 swing high took 10 weeks to unfold, not just a few days.

The point we’re attempting to make is that while MM is bullish into Christmas the market has already bounced back ~50% of our target in just 2-days! The journey upwards, assuming we are correct, is likely to be a volatile one with plenty of swings and roundabouts i.e. for people who have followed our contrarian view and gone long equities will need some fortitude along the way, but ultimately we believe patient bulls will be rewarded.

- MM believes the ASX200 is set to test the 7200 area into Christmas, already not far away.