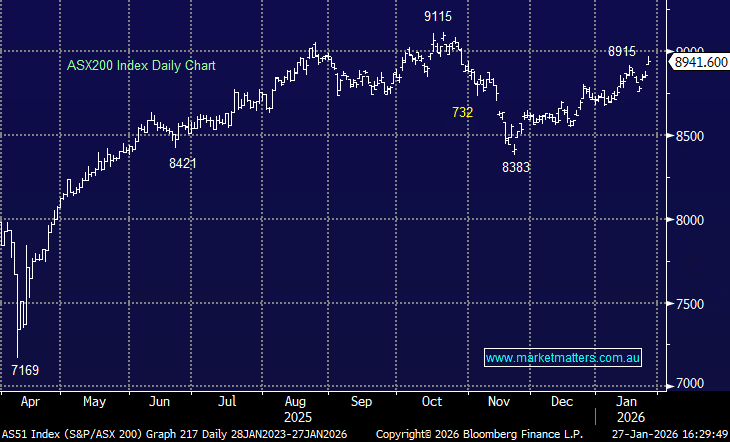

Over the past month, the ASX has fallen 8.5% before dividends, and fund managers are highly leveraged to this negative move given marked to market funds under management (FUM) falls by a similar amount and that impacts management fee income. They also have the added impost of outflows, with the majority of active managers having experienced this over the past 12 months or so – it’s clearly a challenging backdrop. We own Pendal (PDL) in the Income Portfolio and have had a number of questions regarding the bid, which is still in play.

When the deal was announced it was framed as a takeover worth around $6 for Pendal shareholders like MM, however, there is a script component to it which means as Perpetuals (PPT) share price has fallen – and fallen more heavily than Pendal’s, so too has the implied bid amount. The deal comprises 1 PPT share for every 7.5 PDL shares held plus a cash component of $1.976. There was a dividend that we also needed to consider with PPT trading ex on the 8th of September, however, that is no longer in play. The value as of yesterday’s close is $5.12 for PDL shares versus yesterday’s close of $4.43. While there is clearly an arbitrage playing out which will influence performance in the short term (hedge funds selling PPT & buying PDL) we think the deal has merit. We also think that the landscape for funds management is changing, with the big players needing to get bigger / more efficient as large super funds beef up their own internal capabilities, while the smaller, specialist boutique firms continue to gain an advantage.