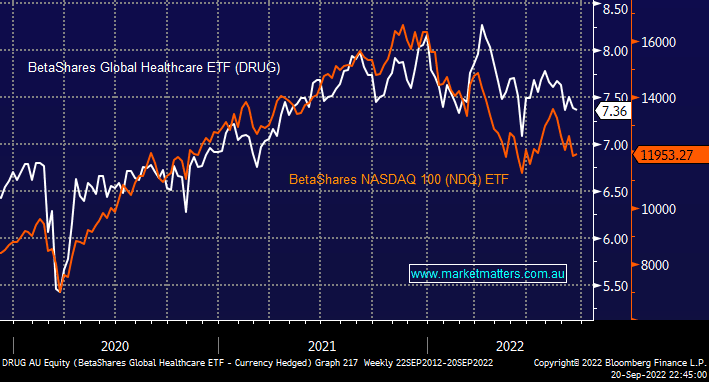

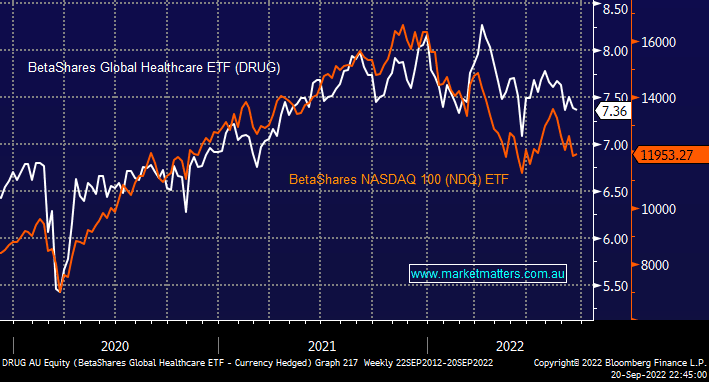

Healthcare stocks can often be regarded as defensive in nature but like the Tech Sector they are also largely recognised as rate-sensitive growth stocks. Since the outbreak of COVID the DRUG & NDQ ETF’s have moved pretty much in tandem with the tech stocks exhibiting a higher beta to interest rate swings i.e. when bond yields finally correct they are likely to rally harder than their healthcare peers but both should perform well.

- Due to their high correlation we don’t believe that the DRUG ETF is an ideal funding vehicle to increase our exposure to the GGOV & / or NDX ETF’s.

- Over the coming days we will look at alternatives although at the moment our positions are mostly aligned with our outlook into Christmas.