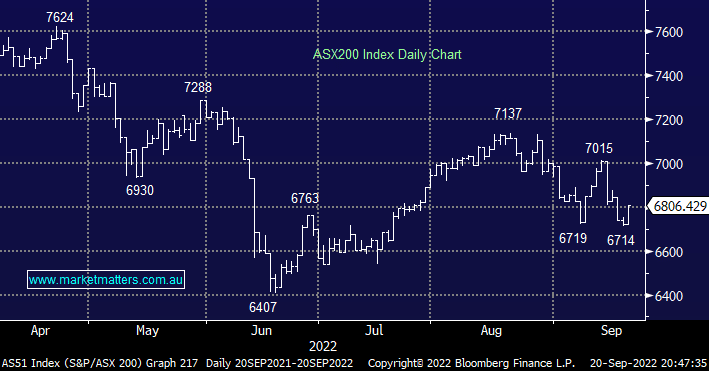

The ASX200 recovered some recently lost ground on Tuesday enjoying broad-based buying but volumes were low, ultimately we saw over 70% of the index close in positive territory. The selling felt a touch exhausted yesterday following the recent aggressive downturn but there may be more bad news waiting in the wings before the weekend arrives:

- The FOMC decision and accompanying minutes will play an enormous role in determining the markets sentiment into October – The Fed’s expected to raise rates by 0.75% and provide further hawkish guidance.

- The Bank of England is considering its largest rate rise in over 30 years as inflation continues to surge higher, the BOE is expected to hike by 0.5% on Thursday but an extreme 0.75% move is definitely not off the table.

In contrast, the minutes from the September RBA meeting released yesterday were fairly ho-hum with the board saying that policy was at or near “normal” settings suggesting a peak in rates, or at least a slowing rate of hikes as we head towards 2023 – a tough read through for the $A if the Fed & BOE still have their feet firmly on the “hike accelerator”. The market’s reaction to the statement was fairly muted with the local 3-years drifting lower while the $A temporarily dipped under 67c with eyes clearly focused on the Fed.

- We’re not expecting any major surprises from the Fed & / or BOE but we do believe another relief rally will then become a strong possibility.

US stocks managed to pare back their losses in the last hour of trade last night but it was still a tough session with the S&P500 falling over -1% as bond yields hit multi-year highs on the eve of the Feds rate decision, even a +1.5% rally by Apple Inc (AAPL US) couldn’t help market sentiment. The SPI Futures are pointing to an open by the ASX200 back down towards 6725, off around 70-points surrendering most of yesterday’s gains in the process.