The ASX200 managed to reclaim a little lost ground yesterday but the bounce was very unconvincing with almost 60% of the main board closing in negative territory – fortunately, the influential banks enjoyed a solid day which offset the more broad-based losses. Elsewhere the Energy Sector continued to defy gravity rallying another +3.7% with all 10 stocks closing up on the day, an impressive performance considering crude oil is still languishing ~25% below its June high.

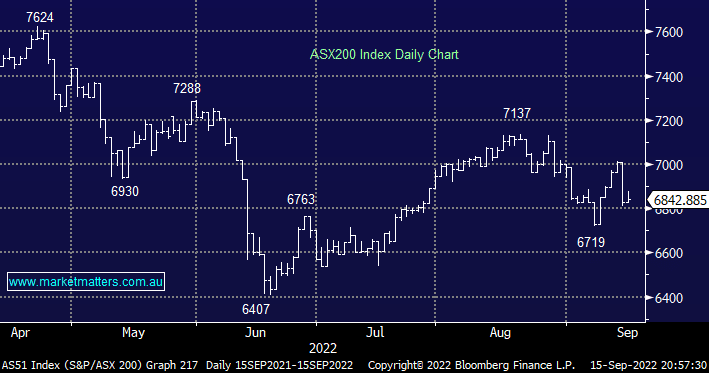

Not surprisingly following the previous day’s carnage it felt like a relief to see the market close in positive territory but there were no signs of meaningful buying and on balance, we still favour a dip towards the 6600 area, or 3-4% lower. However, as subscribers know MM remains in “buy mode” even after some recent purchases but by definition, as our cash level falls we will become more pedantic with our commitment of further funds but we still expect to be fully committed to equities over the coming weeks.

Australia and the US have been hit by rail disputes about pay & conditions, we’ve seen strikes in NSW while President Biden appears to have avoided such disruptive action in the last 24 hours although agreements still appear tentative. The important issue here is the goliath of 2022, inflation, which is stoked by rising wages and as interest rates rise due to inflation people want more pay and the painful merry-go-round keeps turning i.e. Political leaders need to contain wage increases otherwise things will ultimately get far worse, a particularly tough gig with elections looming every few years.

US stocks continued the week’s decline overnight with the S&P500 falling -1.1% to levels not seen since July, the story was the same rising bond yields weighing on stocks and in particular the growth stocks e.g. the NASDAQ 100 fell -1.7%. and traders are now 2nd guessing whether the Fed will hike 0.75% or 1% next week, we favour the more conservative move but markets hate uncertainty.