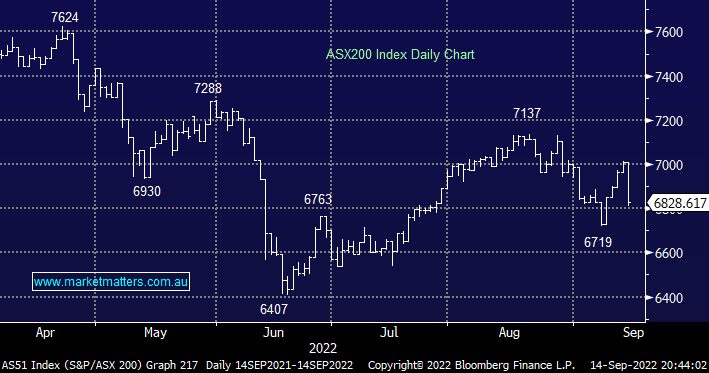

The ASX200 was clobbered over -2.5% yesterday wiping over $60bn from the local index following steep losses on Wall Street after Tuesday’s US CPI demonstrated that inflation remains stubbornly high. Waking up to a 1300-point rout on Wall Street is enough to scare any investor but we should consider the previous few sessions before throwing the baby out with the proverbial bathwater:

- Equities in both Australia and the US ran up strongly into the CPI leaving plenty of room for disappointment which of course they received – August saw inflation rise by +0.1% as opposed to the largely anticipated fall of -0.1% MoM.

- Hence we feel the subsequent drops weren’t too bad i.e. the ASX200 retraced only 60% of its 4-day gain while it was a touch tougher for the tech-heavy S&P500 where the number was over 75%.

However, while ongoing volatility and lower prices into next week’s Fed rate hike wouldn’t surprise MM we remain bullish over the coming months into Christmas and in “buy mode” until our forecasted roadmap for financial markets deviates from our path. Following yesterday’s steep decline we feel the balance of probability has swung in favour of the ASSX200 again testing the 6600 area, last visited in July, but again we reiterate our view that this would be a buying opportunity:

- At the start of 2022 MM called this a year to “buy weakness and sell strength, with the emphasis on the sell side of the equation for the first time since the GFC” – again there’s no change to this standpoint.

- MM has relatively elevated cash holdings across our portfolios leaving us in the solid position of accumulating stocks into the current weakness i.e. subscribers should expect us to be active in the coming days/weeks.

NB: We have experienced technical difficulties sending out our recent trading alerts via SMS. Our SMS provider (Twilio) changed some settings on their backend which has impacted our automated process. This is being fixed and SMS notifications will recommence shortly. Interestingly, Twilio (TWLO US) rallied 10% overnight after announcing job cuts following a tough 12 months – the stock down from $US350 to $US78 overnight.

US stocks rotated around the unchanged level overnight before edging higher into the close, the SPI futures are calling the ASX200 to open unchanged this morning ~6830.