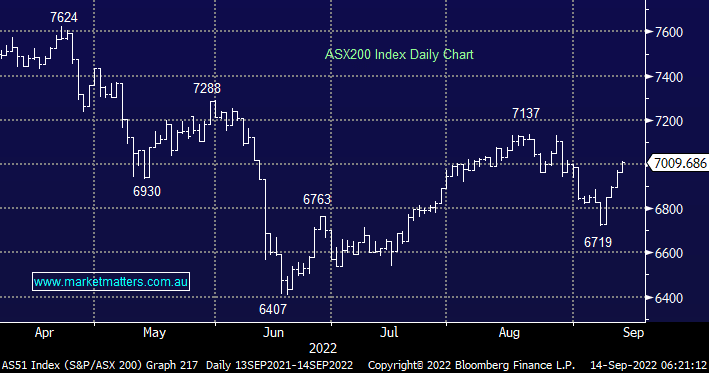

The last 4 sessions have seen the ASX200 recover strongly from last week’s early sell-off impressively taking the index back into positive territory for September – to be exact it rallied 4.4% from last Wednesday’s low as investors appeared to “square up” ahead of the overnight US inflation data. Tuesday’s advance was again broad-based with over 80% of stocks closing up on the day led by the Real Estate Sector for a change but it was again the lack of meaningful selling which saw the main benchmark close above 7000. This lack of selling came as no surprise to MM although the rally was stronger than we expected courtesy of a positive lead from the US equities:

- U.S stocks also rallied for 4 straight sessions on optimism that softening economic data and inflation will allow the Fed to slow the pace of its rate hiking cycle after the Sep FOMC meeting where a 0.75% rise feels like laydown misère.

- A degree of relief was being afforded to stocks with the Fed now in its two-week blackout period ahead of the September FOMC meeting i.e. a rest from the multitude of hawkish comments that have been thrown at stocks over the last fortnight.

- Markets were hoping the ~23% fall in oil prices will see headline inflation in August fall by 0.1% MoM and the annual rate slowing to 8.1% from 8.5%.

The CPI overnight dashed all of these “hopes” which had led to a strong recovery by stocks with inflation coming in hotter than expected at +0.1% as opposed to the -0.1% consensus call. US stocks unravelled overnight to deliver their worst decline in over 2-years with the Dow closing down almost 1300-points and the NASDAQ tumbling over 5%.

- The US CPI @ +0.1% led to the S&P500 falling -4.3%, The $US Index rallying +1.4% and US bond yields surging with the US 10-years testing their June 3.5% high.

The dramatic falls across US stocks saw the SPI futures tumble -2.4% overnight pointing to an open for the ASX200 this morning back around the 6850 area, down around 170-points.