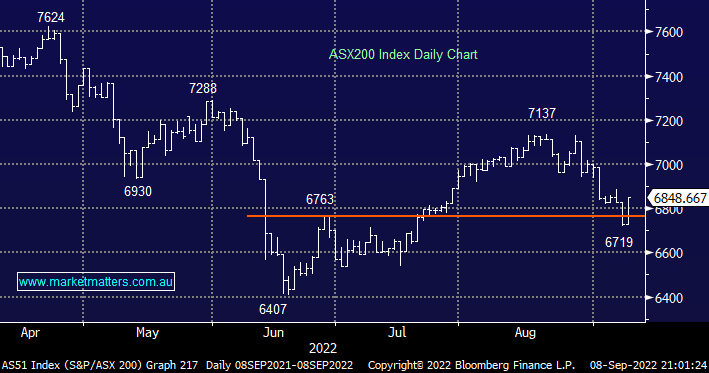

In yesterday’s Morning Report we wrote “we remain confident the market will be higher come “Auld lang Syne” i.e. the start of 2023.” That line looks pretty good following the ASX200’s 117-point / 1.8% RBA inspired rally on Thursday but to use an old cliché one swallow doesn’t make a summer and we wouldn’t be vaguely surprised to see another test on the downside towards major technical support in the 6600 region over the coming weeks.

Thursday’s rally was extremely broad-based with over 90% of the ASX200 closing up on the day led by the interest-sensitive Tech Sector which closed up +3.2% while only the Energy Sector closed lower with Woodside Group (WDS) trading ex-dividend not helping the group. Over the coming months into Christmas we are looking for a continuation of this outperformance by growth stocks over value although again were not convinced the inflection point has been reached.

The SPI futures are pointing to a flat open this morning with yesterday’s rally feeling like it was already building in a positive night on Wall Street i.e. the Dow rallied +0.6% last night.

- We believe it’s too early to call a September / October bottom but we are definite buyers of further weakness.