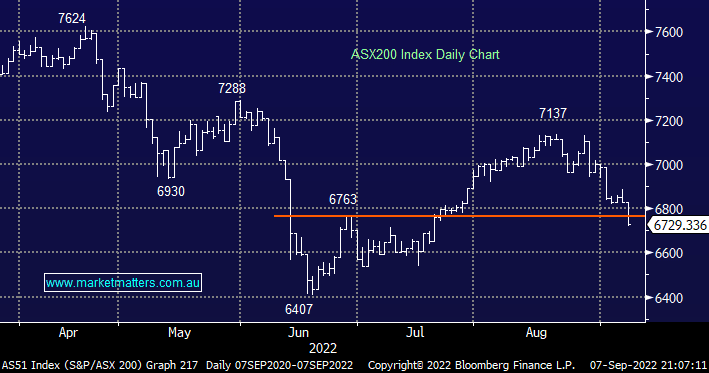

The ASX200 was simply whacked on Wednesday closing down almost 100-points on fairly broad based selling which saw over 70% of stocks close in the red, losses were led by the influential resources and financials names e.g. Commonwealth Bank (CBA) -2.1%, National Australia Bank (NAB) -3.1%, BHP Group (BHP) -2.7% and South32 (S32) -2.3%. We dipped our toe back into the market in the afternoon, more on those moves later, on balance we feel that Goldman Sachs might be correct with their latest piece of headline grabbing research “Goldman Strategists warn stocks yet to make “decisive” low” :

- Global stocks are enduring their worst run since the European debt crisis more than 10-years ago but Goldmans fear there’s more to come.

- The US based investment bank are citing the obvious plethora of macro headwinds to cause the ongoing weakness e.g. Feds hawkish policy, Europe’s energy crisis and Chinas economic slowdown.

- They’re also calling a ~30% chance of a recession in the next 1-2 years which doesn’t help matters in an already nervous market.

We labelled the bounce from mid-June as a probable Bear Market Rally and at this stage it is looking like a fair call but it’s important to remember that not all stocks will bottom at the same time and we feel it’s prudent to slowly accumulate when things look bad in an effort to achieve a good entry average into stocks we like moving forward – being overweight cash affords us this luxury. In the first part of today’s report we have mentioned a few stocks on our radar in as we refine our target areas into the current market slide.

- As the selling continues to gather momentum we are now calling a 70% probability that the ASX200 will break the June 6400 low.

- However as investors continue to build their cash reserves from already high levels we can see a dearth of sellers on the horizon in the coming weeks / months.

We are can see stocks lower short-term but at this stage we remain confident the market will be higher come “Auld lang Syne” i.e. the start of 2023.