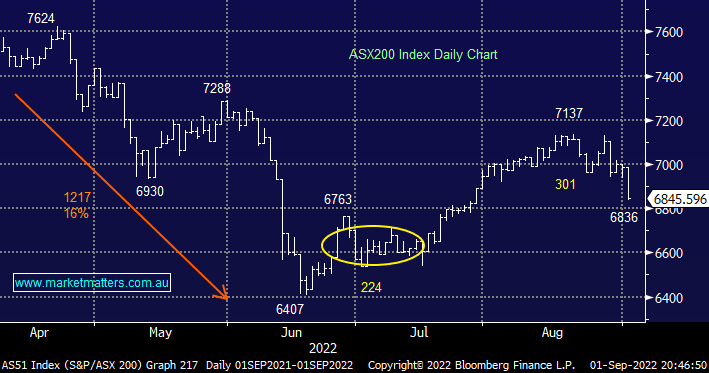

The ASX200 has kicked off September in a similar tone to the back-end of August, yesterday’s 141-point drop may have felt particularly aggressive to some observers but we shouldn’t lose sight of the significant influence of BHP trading ex-dividend, it was effectively 33% of the whole markets decline! However, the broad-based selling which resulted in less than 10% of the main board managing to close up on the day would have delivered some definite Spring cheer to the bears. Globally we saw stocks and bonds (rates higher) extend their recent slide as China lockdowns amplified the market’s worries post Jackson Hole.

The Resources Sector led the declines through the week’s penultimate session as the combination of expected ongoing aggressive Fed tightening and China’s extended slowdown will lower demand for commodities i.e. pretty much in-line with our conclusion in Thursday’s report – “Recession fears could be creeping back into commodity markets”. Industrial metals continued their recent slide with copper down another -2% before most Australians even went to bed:

- Yesterday saw China lockdown Chengdu’s 21 million residents to contain yet another Covid-19 outbreak as they try to implement Xi’s zero Covid policy – Australia’s total population is less than 26 million!!

It’s hard to imagine a short-term respite for commodities as the world’s largest consumer goes back into hibernation. When we combine this recent backward step from Beijing with the ongoing political risk from the Russia-Ukraine conflict, tensions around Taiwan plus of course Jerome Powell’s tough talk from Jackson Hole last Friday its suddenly easy to imagine the current pullback for stocks going deeper than many, including ourselves, initially imagined – plus seasonally equities usually struggle through September.