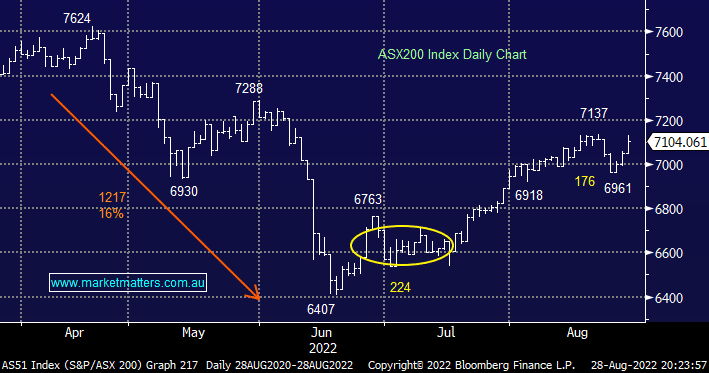

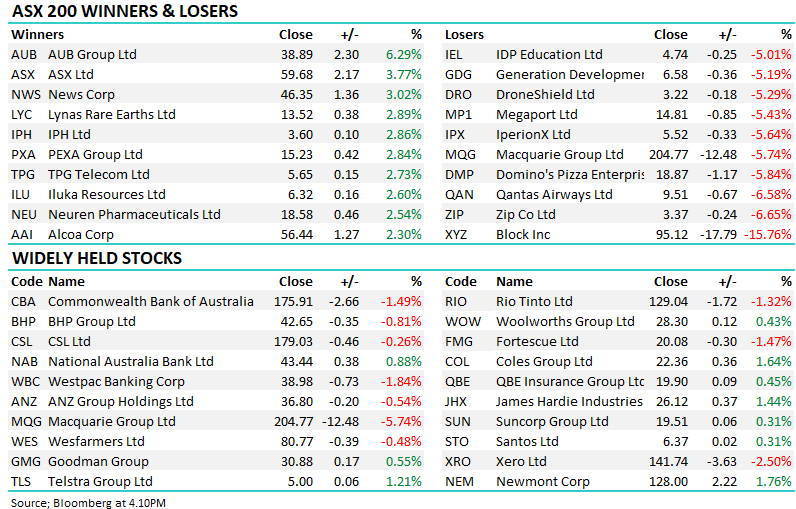

The ASX200 is set to open down 100-points this morning back around the 7000 level following the weakness across US stocks. Assuming we follow the lead from global bourses it’s the growth stocks that will wear the brunt of the selling while the defensives should outperform. We see 2 different paths unfolding over the coming weeks following the Feds very clear message on Friday:

- Our preferred scenario is the ASX200 will correct back towards the 6900 area with tech stocks likely to surrender most if not all of their recent gains.

- Alternatively the Fed may have really hurt equities and the local index is headed back under 6400, a break of 6750 is required for MM to ring alarm bells that this could be unfolding.

We will be monitoring other triggers that it’s again time to go “all in” towards stocks looking for a strong rally into Christmas e.g. Bond yields popping to fresh multi-year highs and failing and Bitcoin making fresh 2022 lows and rejecting. However, we are overweight cash and do plan to slowly accumulate into weakness as opposed to attempting the pick “the low” in stocks into Christmas.