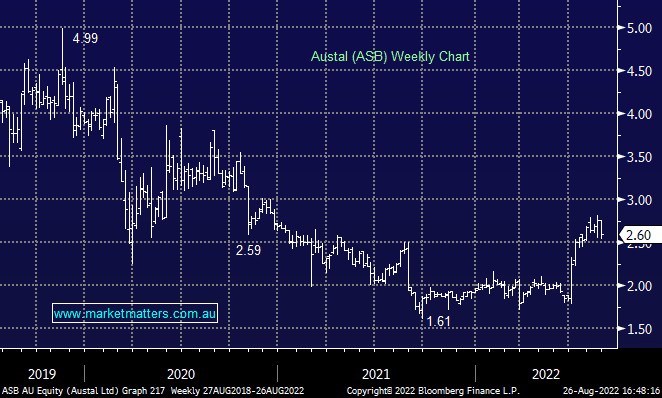

ASB -2.26%: the shipbuilder announced a good set of numbers for their FY22 result today, though it failed to ignite the stock. EBITDA was in line with pre-guided numbers at $120.7m, up 5.3% on the back of the recently awarded OPC contract that could be worth up to $3.3b in revenue. It’s positive to see the new steel shipbuilding facility being put to work and generating new business with the company noting a larger pipeline of long-term contracts they are now available to submit tenders for. The order book grew to $3b, up from $2.5b and they guided to $100m EBIT for FY23, around 10% ahead of the market, though consensus had largely remained unchanged since the announcement of recent contract wins.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

BetaShares Geared ASX200 ETF (G200) v BetaShares ASX200 ETF (G200)

BetaShares Geared ASX200 ETF (G200) v BetaShares ASX200 ETF (G200)

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish and long ASB in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Q&A for Sat Weekend report – ASB & XRO

Thoughts towards Austal (ASB)

Thoughts on ASB after its downgrade?

Thoughts on Capitol Health, Austal and Standline Resources?

Austal (ASB) – is it a buy?

Is Austal a takeover target?

Austal (ASB) share price decline

Relevant suggested news and content from the site

chart

BetaShares Geared ASX200 ETF (G200) v BetaShares ASX200 ETF (G200)

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.