The ASX200 rallied strongly on Thursday helped by a bounce in US stocks, a couple of strong company reports and further corporate activity as Perpetual (PPT) and Pendal Group (PDL) look to have finally tied the knot – M&A was added to overnight as the next stage of the KKR v Ramsay Healthcare (RHC) saga was released, more on this later. Market sentiment was also helped by Japan looking to restart nuclear power as the idealistic alternatives fail to match the country’s energy demands – it’s been well over a decade since the 2011 Fukushima disaster hammered consumer confidence in nuclear power but time can heal many wounds.

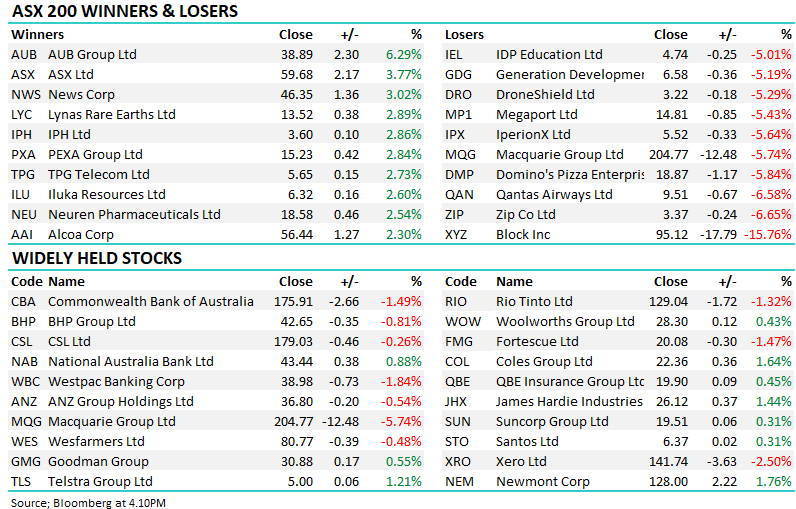

The Resources Sector remains strong and while nuclear stocks have little influence on the index investors always like to see their holding jump by over 10% e.g. Paladin (PDN) +11.6% and Bannerman (BMN) +15.4%. We did read one comment that reminded us that commodity prices and the miners are cyclical in nature which can prove great selling just when they look unstoppable – South32 (S32) chief Graham Kerr is concerned that cashed-up resources companies will be under the microscope of post-Covid indebted states & countries i.e. he’s cautious of higher taxes and royalties.

There was also some much-needed love for the gold buffs yesterday with a small bounce by the precious metal appearing to trigger some short covering & / or bottom picking in this struggling sector e.g. Regis Resources (RRL), Silver Lake Resources (SLR), Newcrest Mining (NCM) and Evolution Mining (EVN) as a group rallied an average of +3.4% trumping the performance of their better-known miners in the process.

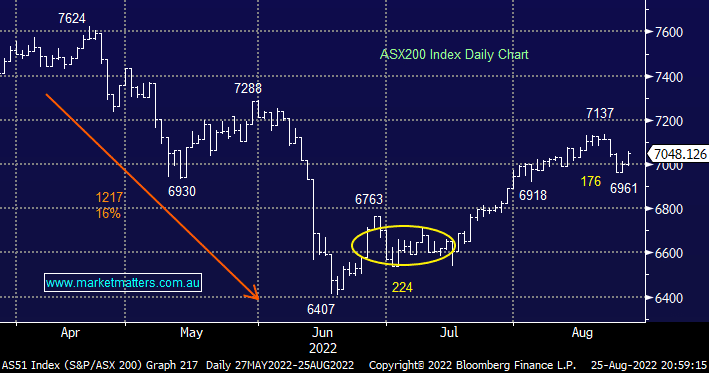

US stocks bounced strongly overnight ahead of Jerome Powell’s statement from Jackson Hole, the ASX has certainly been the leading index this week. The day’s performance was helped by solid jobs numbers and a general acceptance that the Fed will maintain its hawkish stance into Christmas i.e. interest rates are going higher. The SPI Futures are calling the ASX to start the day basically unchanged looking set to take a rest ahead of the much anticipated Fed rhetoric.