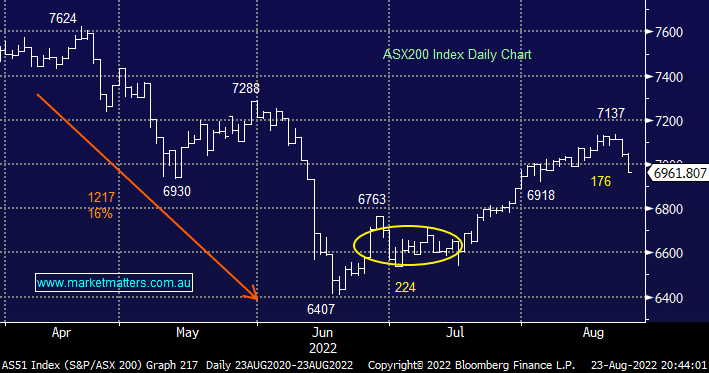

The ASX200 is falling as we’ve been anticipating although most of the action is unfolding on the stock & sector level, our best guess is the local index will consolidate around the 6900 area although considering our view on bonds and the current picture with some influential names a deeper move wouldn’t surprise us.

- We feel far more in tune with the controlling bonds and stocks/sectors in comparison to the underlying index which is a good thing as this is our focus at MM.

- However our “Gut Feel” is the 6900 area represents a good level to start slowly increasing risk while leaving plenty of ammunition to keep buying a deeper move.

- September could easily be a month of begrudging consolidation as different sectors take it in turn to support a heavy index.

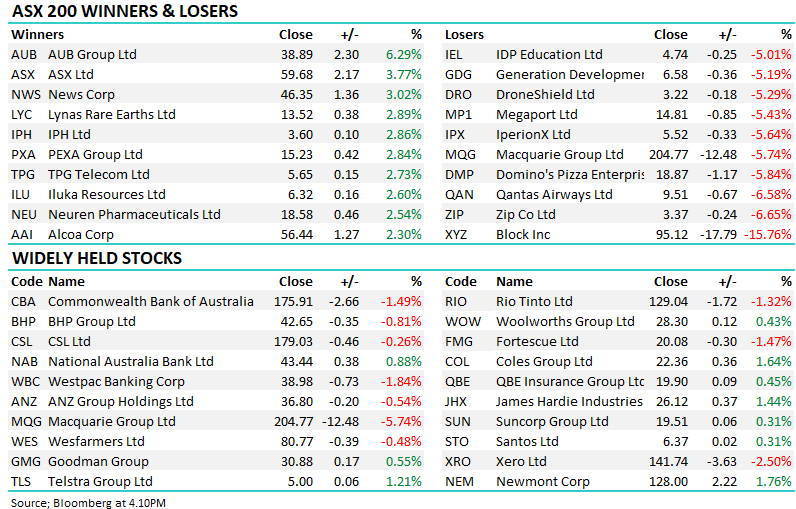

US stocks closed mildly lower overnight in a choppy session that saw tech stocks pass on the worst performer baton to the Real Estate Sector, but overall it was a quiet session as people wait for some clarity on the likely Fed hiking path from the Jackson Hole central bankers symposium later this week. US 10-year bonds remained firm above 3% as traders brace themselves for a hawkish message from the Fed. The ASX200 is set to open slightly higher this morning following no major leads from overseas.