The ASX200 endured one of its worst days for months on Monday with broad-based selling washing through the main board although it was the banks and IT stocks which caught our eye on the downside. Buyers of the dip evaporated as concerns around inflation & rate hikes returned to haunt the recent bulls of tech/growth names not helped by Australian 10-year bond yields testing their 1-month high, back above 3.5%.

- MM believes the last few day’s advance by bond yields and subsequent fall in stocks and specifically in the yield-sensitive names has further to play out.

- However we continue to believe this will be a move to fade, ideally into a panic blow-off by yields e.g. Australian 10-years above 4.25%.

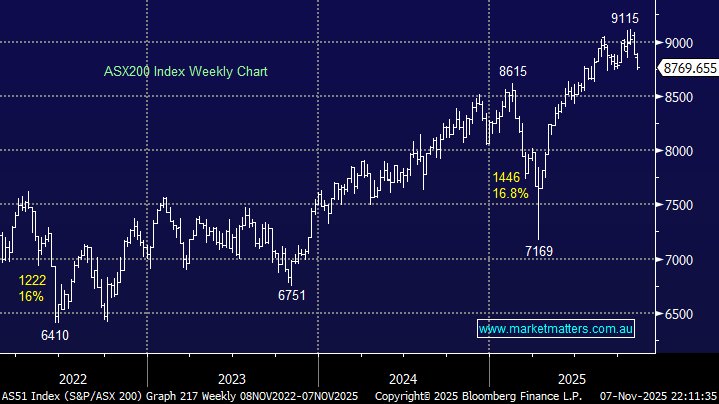

Interestingly recent losses have been softened by a firm Resources Sector indicating that recession fears are currently taking a back seat to interest rates however if we follow the same rhythm which markets experienced between May & July the big “R” word will again raise its head before stocks can really regain a traditional Christmas Rally.

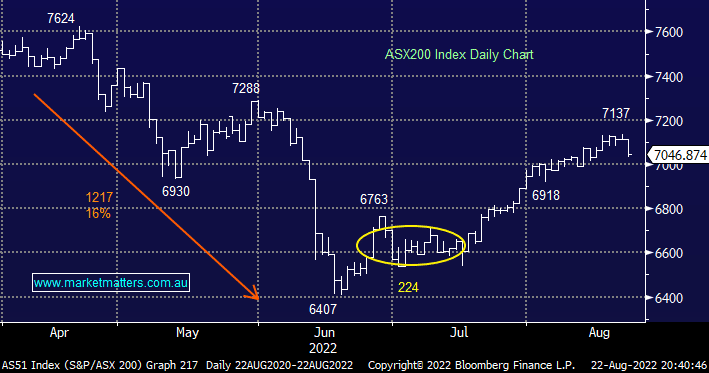

- The tech stocks bottomed in June in line with bond yields while the resources kept falling into July as recession fears escalated dragging down commodity prices in the process.

Both the US and local reporting season has largely been supportive of stocks with a local beat-to-miss ratio of 3:2 but with the US now moving onto Jackson Hole and Australia well over halfway through this fundamental tailwind equities look destined to be superseded by macro influences and they’re looking fairly wobbly at present.

US stocks came under intense selling pressure overnight as traders & investors closed positions ahead of a potentially hawkish Jackson Hole later this week, the S&P500 endured its worst fall in 2-months after stocks enjoyed an impressive $US7 trillion dollar rally from mid-June. The trend of the last few days continued to unravel through risk markets with US 10-years topping 3%, bitcoin falling, the Euro hitting 20-year lows and tech stocks leading the main board lower, the NASDAQ closing down -2.7%. The SPI Futures are calling the ASX200 down 50-points on the open this morning back to the 7000 area.