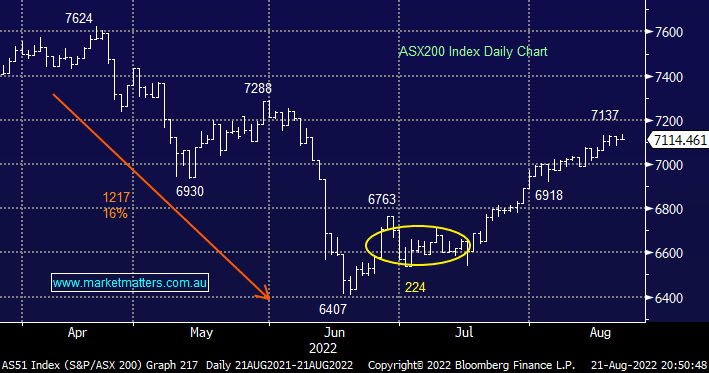

The ASX200 is set to open back around 7080 this morning following a tough session on Wall Street where falls were spearheaded by the financials, tech, materials and consumer discretionary names – we wouldn’t be surprised if the -0.4% fall by the SPI on Friday proves optimistic this morning.

- The upside momentum has waned through August although the short-term trend remains bullish, if not a touch tired for now – a major technical breakdown doesn’t occur until we see a close below 6750.

- Our preferred scenario is the local market will pull back begrudgingly towards the 6900 area over the coming weeks i.e. around 3% below Friday’s close.

Assuming our view towards bonds and Bitcoin is correct there obviously remains the potential for stocks to fall harder but we don’t believe the markets long & / or bullish enough to accelerate on the downside although we can see more aggressive declines by the rate-sensitive stocks/sectors.