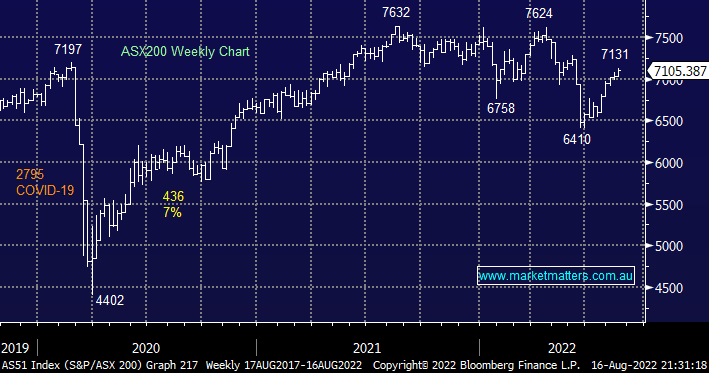

The ASX200 has rallied further than we expected from its June low and the prospect of a break back under 6400 feels like it’s diminishing fast, but we do still expect a decent pullback in the coming weeks/months and the latest Bank of America Fund Managers Survey out overnight added some weight to this standpoint:

- Investors are no longer “apocalyptically bearish” stocks with 88% of Fund Managers (FMS) surveyed now expecting lower inflation in the next 12 months.

- Exposure to cash was reduced to 5.7% but it remains well above the long-term average of 4.8%.

- Under the hood investors rotated into technology & consumer-facing shares and away from defensives such as utilities and consumer staples – in other words, investors moved up the risk curve.

- The most crowded trades are long the $US, oil, commodities and FAANG stocks.

US stocks had a mixed session overnight with tech falling while Consumer Staples & Discretionary Sectors both rallied – the NASDAQ Index slipped -0.2% while the Dow rallied +0.7%. US 2-year yields rallied back above 3.25% weighing on growth stocks but beats by Walmart Inc (WMT US) and Home Depot Inc (HMT US) helped drive prices higher across a number of retailers buoying optimism in the process. The SPI Futures are calling a slightly firmer opening this morning with a big day of reporting ahead.