The ASX200 knocked on the door of its August high yesterday before finally closing up +0.45% on broad based buying which saw over 67% of the main board close in positive territory. If it hadn’t been for a disappointing report from Bendigo Bank (BEN) which fell over 8% dragging much of the sector down in sympathy we could have been testing 7100 but with Commonwealth Bank (CBA) trading ex-dividend $2 fully franked on Wednesday it may prove a touch too much to ask this week.

- Following its -8.4% drop yesterday BEN is forecast to yield well over 5% over the next 12-months but before people ask it’s still not for us “if it’s now a buy for Septembers 26.5c fully franked dividend?”.

The Australian reporting season is less than a quarter of the way in but the initial signs are solid with a definite scarcity of negative leads from a the uncertain economic backdrop. Conversely the US earnings season is in the home straight with the giant retailers front and centre over the coming days with reports looming from house hold names Wal-Mart, Home Depot, Target and Lowes although importantly for the indices expectations are low after sector downgrades through 2022.

- US reporting season and the start of our own have delivered nothing to excite the bears at this stage.

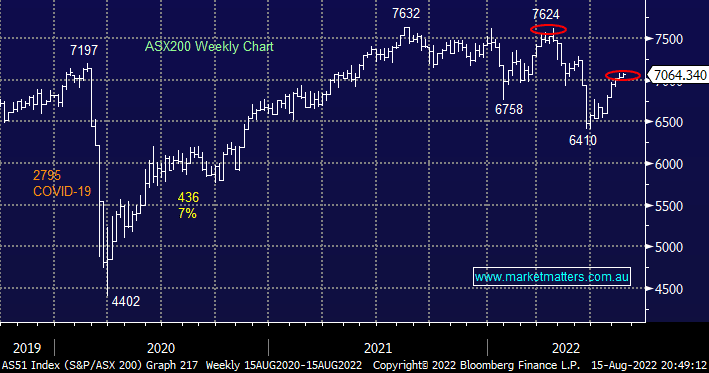

Seasonally we are now entering an historically quiet few months for stocks before October often provides some fireworks, considering the swings already this year a few weeks / months of consolidation wouldn’t surprise but as we’ve written before MM is in “Buy mode” looking for opportunities to increase risk, ideally into weakness with a close below 6750 required to skew us bearish.

Last night was an impressive night for US stocks, not because the S&P500 gained +0.4% but because of the manner in which it shrugged off weak data on New York manufacturing and the Chinese economy. US stocks are attempting to post their 5th consecutive weekly gain and their cause wasn’t helped by a slew of surprisingly weak Chinese data including retail sales and industrial output but the PBOC reacted swiftly cutting a key policy interest rate, they’re clearly worried! The SPI Futures are pointing to a 25-point gain early this morning with tech stocks likely to remain firm.