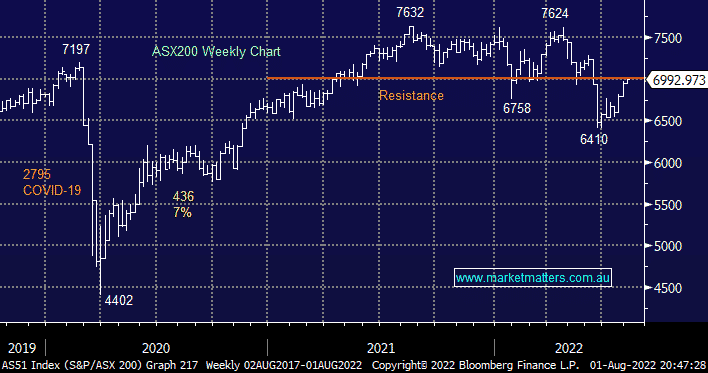

The local market rallied 48-points yesterday but the gains weren’t particularly broad-based with less than 60% of the ASX200 managing to close up on the day but when BHP, CBA and CSL rally an average of ~1% the index is likely to follow suit. We remain mindful that historically stock markets often make their high, or low, in the 1st few days of any month hence we remain comfortable maintaining our neutral approach after the market’s 9% recovery from its June low.

- MM is neutral equities short-term, we will now wait for them to show their hand after a classic seasonal June – July bounce.

Overnight US stocks fell slightly even as US Treasury yields slipped to their lowest level since April ignoring the Fed reiterating it will need to hike rates further to control inflation. It was a choppy start to the week in the US with energy stocks the weakest on ground falling -2.2% following an aggressive ~4% pullback in crude oil, the SPI Futures are pointing to open down around -0.25% ahead of the RBA’s decision this afternoon.