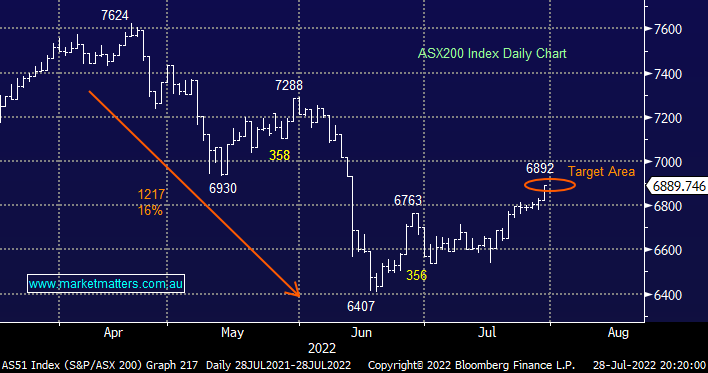

The local market rallied 1% yesterday reaching our short-term target zone hence we tweaked a few holdings affording us some flexibility over the coming weeks & months. Interestingly, the ASX focused more on the reduced risk of recession into 2023 as opposed to the fall in bond yields with the Resources Sector significantly outperforming the tech stocks although we did see the defensive skewed Utilities and Healthcare Sectors close in the red i.e. underperforming similar to the US.

- MM has been flagging a more conservative stance if / when the ASX200 headed towards the 6850-6900 area – hence we trimmed 3 holdings in the Flagship Growth Portfolio on Thursday taking our cash position to 7%, and up around 9% in our Emerging Companies Strategy, while the Income Portfolio is set to receive the proceeds from the redemption of the Crown Hybrid, equivalent to ~4%, although we have a destination in mind for this- watch for alerts here today.

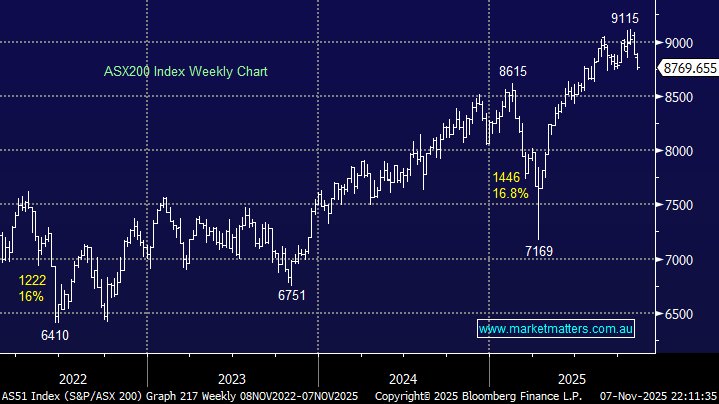

Overnight US stocks extended gains with the defensive skewed real estate and utilities both rallying over 3% but there was an absence of selling across the index which helped the S&P500 rally another +1.2%, the SPI futures are pointing to an +0.9% open this morning challenging the 6950 area.