The ASX200 enjoyed a noticeably strong match-out yesterday in what had been a fairly lacklustre session, the market finally closed up +0.5% showing a current lack of appetite to go home short, it’s feeling like a classic “bear squeeze” i.e. just what MM has been looking for since mid-June. To back up our opinion the recent stock/sector rotation back into the underperformers of 2022 reaffirms our view that we’re seeing capitulation by bearish traders as opposed to a meaningful change in trend i.e. a quick glance at yesterday’s 5 best performers and their performance through 2022 paints a very clear “short squeeze” picture:

Winners: Telix (TLX) +21% but its -13% ytd, Zip (ZIP) +17% compared to -82% ytd, Kelsian Group (KLS) +15% but its -16% ytd, Link (LNK) +13% but its -20% ytd and Novonix (NVX) +12% while its -73% ytd – comparatively the ASX200 is currently down less than -9% for 2022.

If we crystalise yesterday’s “Top 5” performers on the ASX200 the message is even clearer – their average gain was +15% but so far for 2022, even after Thursday’s gain, their average decline since January 1st is -41% i.e. the market wasn’t chasing quality stocks it felt were cheap yesterday, it was covering the “dogs” of 2022 to reassess at a later date just in case we get a major squeeze. History tells us “short squeezes” are usually sharp aggressive upside moves that eventually see the underlying market resume its bearish trend after inflicting as much pain on the aforesaid traders as possible.

- “A bear market is like a ping pong ball falling down a staircase, it will bounce sharply at times but it’s eventually going to reach the bottom of the stairwell” – Shawn, MM’s Research Lead.

MM has been targeting a bounce towards the 6850-6900 since last month and now it’s close to fruition its very important that subscribers understand that by definition the local market had to feel good / relatively bullish in the first place to get here, obviously, we may be wrong and the ASX200 has indeed found a major a low and it will be rallying strongly back above 7000 into Christmas but from a risk/reward perspective MM is looking to tweak our portfolios into the current strength:

- MM is looking to follow our flagged plan to rotate our Flagship Growth Portfolio down the risk curve into the current strength i.e. we no longer want to be very overweight growth and tech stocks.

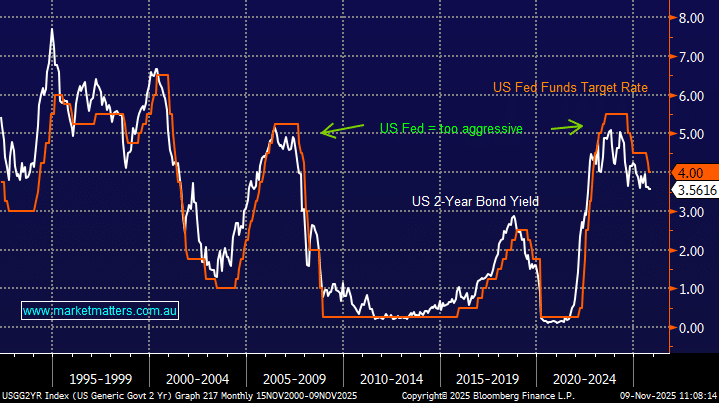

Overnight we saw US stocks maintain the recent trend with their significant Tech Sector rallying +1.4% dragging the broad market up 1% with a +9.8% surge by Tesla (TSLA) catching our eye after it beat the streets estimates. US 10-year yields dipped back under 3% following a softening in the labour markets whereas in Europe the ECB hiked rates by 0.5%, the region’s first hike in 11-years and the biggest since 2000. The SPI Futures are pointing to a firm open around 10-points higher with any gains likely to be led by the tech stocks.