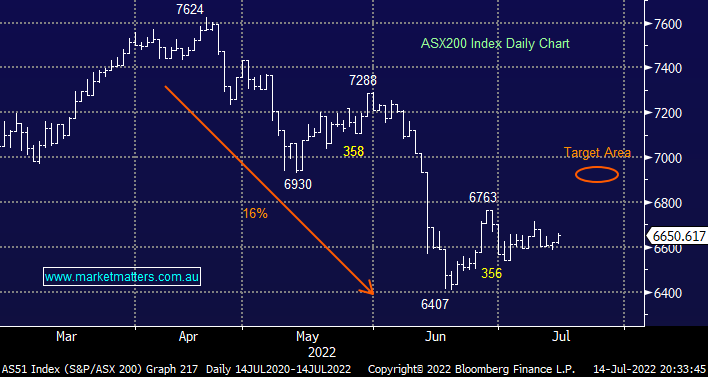

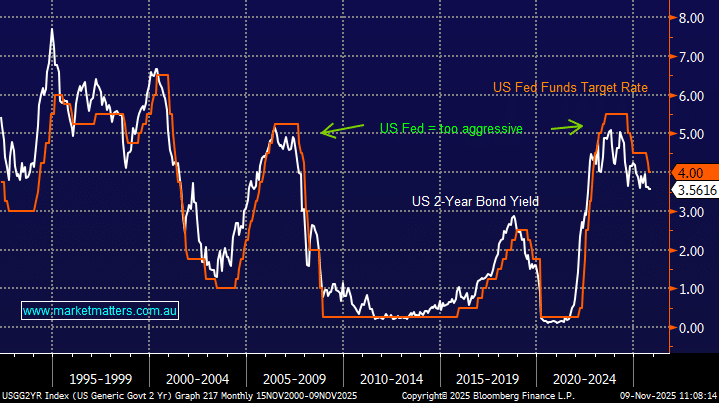

The ASX200 shrugged off red hot US inflation on Thursday to eke out a solid +0.4% gain with Tech stocks finally leading the line even as bond yields rallied and pundits started weighing up whether the Fed would follow the Bank of Canada and hike interest rates by 1% come their July 28th meeting – it feels almost ironic that markets are convinced interest rates will accelerate higher just as a 3rd wave of Covid casts another dark shadow over the economy. Bond markets are effectively telling us they have very little faith that the Fed can successfully & orderly navigate the current 40-year high inflation rate:

- The US interest rate market is looking for another 1.75 to 2% of interest rate hikes by the Fed into Christmas which will mean the Official Rate has leapt from 0.25% to 3.75% in just 12 months – a major headwind for equities.

- However longer-dated yields fell overnight taking the yield-curve inversion to levels not seen for 20 years, in other words money markets are almost convinced we will see a recession in 2023.

- The same money markets are now starting to price in rate cuts next year from late Q1 as they bet the Fed will go too hard to crush inflation.

Personally, I find it frustrating that central banks who ignored all of the early signs of inflation in 2021 now look set to cripple the global economy in an effort to put the inflation genie back in the bottle, I’m sure the average person on the street would prefer some “slow & steady” monetary policy to tweak economies as required.

However for now MM is very encouraged to see the tech stocks start to regain their “mojo” when arguably the macro-economic news couldn’t be worse – perhaps too many investors have already migrated their portfolios to a more defensive stance leaving few sellers in the high beta / “risk on” end of town.

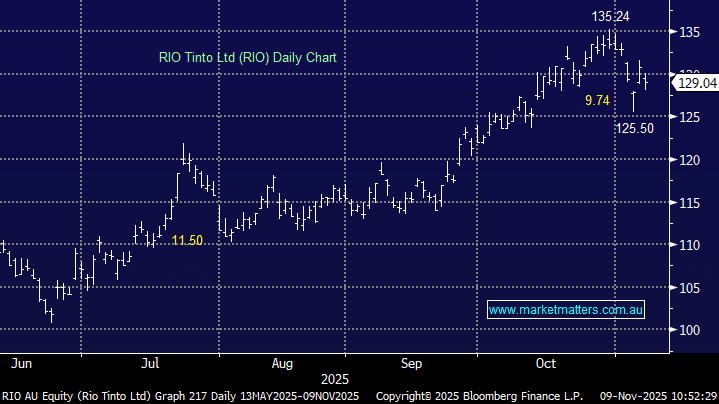

Overnight we saw US stocks again recover from an early aggressive sell-off following further hawkish economic data but comments from Fed members that they would be backing a 0.75% rate hike this month was enough to help the tech sector reverse early losses and close up +0.3% – clearly, people had been skewing their positions towards a 1% hike later in the month. An average result from JP Morgan and an almost 7% plunge by iron ore looks set to weigh on the influential Australian resource stocks today hence the SPI Futures are pointing to a 50-point drop early on by the ASX200.